Understanding your Walmart paystub is crucial for keeping track of your earnings and ensuring accuracy. With a comprehensive paystub, you can easily monitor your income, deductions, and contributions. This guide will walk you through 18 essential tips for decoding your Walmart paystub, empowering you to take control of your finances and make informed decisions.

1. Know Your Pay Period

The first step in understanding your paystub is recognizing the pay period it covers. Walmart typically operates on a bi-weekly pay cycle, with paydays falling on Wednesdays. However, some positions may have different pay frequencies, so it's essential to verify your specific pay period. This information is usually indicated at the top of your paystub, alongside your pay date.

2. Check Your Gross Earnings

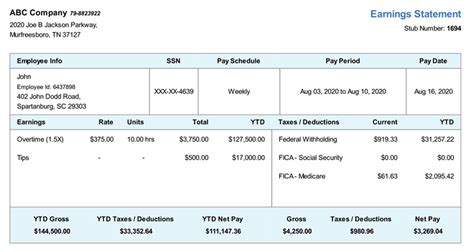

Gross earnings represent your total income before any deductions or contributions. It includes your base pay, overtime, bonuses, and any other additional earnings. Ensure that your gross earnings align with your expectations and the hours you've worked. If you notice any discrepancies, reach out to your supervisor or HR department for clarification.

3. Understand Regular Earnings

Regular earnings are the wages you receive for your standard work hours. This section of your paystub details your base pay rate, the number of hours worked, and the total regular earnings for the pay period. Verify that your regular earnings accurately reflect your agreed-upon hourly rate and the hours you've logged.

4. Review Overtime Earnings

Overtime earnings are calculated at a higher rate than your regular pay and are applicable when you work beyond your standard work hours. Walmart typically pays overtime at time-and-a-half, meaning you receive 1.5 times your regular hourly rate for each hour worked beyond your regular shift. Ensure that your overtime earnings are correctly calculated and reflect the correct overtime rate.

5. Identify Deductions

Deductions are amounts withheld from your gross earnings for various reasons, such as taxes, insurance premiums, and retirement contributions. It's crucial to review these deductions carefully to ensure they are accurate and reflect your choices. Common deductions on a Walmart paystub include federal, state, and local taxes, as well as Medicare and Social Security contributions.

6. Understand Tax Withholdings

Tax withholdings are deductions made from your earnings to cover federal, state, and local income taxes. These amounts are based on the information you provided on your W-4 form and your tax filing status. Review your tax withholdings to ensure they align with your tax obligations and personal financial goals. If you notice any discrepancies, consult a tax professional for guidance.

7. Review Insurance Deductions

If you have enrolled in Walmart's insurance plans, such as medical, dental, or vision insurance, you will see deductions for these premiums on your paystub. Verify that the amounts withheld match your selected coverage levels and that you are satisfied with your insurance choices. Remember, insurance deductions are pre-tax, so they can help reduce your taxable income.

8. Check Retirement Contributions

Walmart offers retirement savings plans, such as a 401(k), which allow you to contribute a portion of your earnings towards your retirement. These contributions are typically made on a pre-tax basis, reducing your taxable income and offering potential tax benefits. Review your retirement contributions to ensure they align with your financial goals and investment strategy.

9. Analyze Other Deductions

In addition to the standard deductions, your paystub may include other deductions, such as union dues, charitable contributions, or uniform allowances. These deductions are specific to your individual circumstances and choices. Review these deductions to ensure they are accurate and reflect your preferences.

10. Understand Net Pay

Net pay, also known as take-home pay, is the amount of money you receive after all deductions have been made. It represents the actual cash you'll have in your pocket or deposited into your bank account. Ensure that your net pay aligns with your expectations and that you understand the components that make up this final amount.

11. Track Hours Worked

Your paystub provides a detailed breakdown of the hours you've worked during the pay period. It typically includes regular hours, overtime hours, and any other special categories of hours, such as double-time or shift differentials. Review these hours to ensure accuracy and confirm that they match your time records.

12. Verify Pay Rates

Walmart offers competitive pay rates, and your paystub will indicate the rates applied to your regular and overtime hours. Verify that these rates align with your agreed-upon pay scale and any applicable wage increases or adjustments. If you have questions or concerns about your pay rates, reach out to your supervisor or HR department for clarification.

13. Review Direct Deposit Information

Walmart uses direct deposit to transfer your earnings directly into your bank account. Your paystub will include your bank account information, routing number, and the date of the deposit. Verify that this information is accurate and up-to-date to ensure timely and accurate payment into your account.

14. Check Accruals and Balances

Your paystub may also provide information about your accruals and balances for various benefits, such as paid time off (PTO), vacation days, or personal days. Review these balances to ensure they reflect your usage and accrual rates accurately. If you notice any discrepancies, contact your HR department to resolve the issue.

15. Stay Informed About Benefits

Walmart offers a comprehensive benefits package, including healthcare, retirement savings, and other perks. Your paystub may include information about your eligibility for these benefits and any associated costs. Stay informed about your benefits options and make informed choices to maximize the value of your compensation package.

16. Review Paycode Descriptions

Your paystub may use specific paycodes to describe different types of earnings, deductions, or contributions. Familiarize yourself with these paycodes and their meanings to better understand your paystub. If you encounter unfamiliar paycodes, reach out to your HR department for clarification.

17. Keep Records for Tax Purposes

Your paystub serves as an important record for tax purposes. It provides detailed information about your earnings, deductions, and contributions throughout the year. Keep your paystubs organized and readily accessible to simplify tax filing and ensure accuracy when reporting your income.

18. Seek Assistance if Needed

If you have any questions or concerns about your paystub or need further clarification on any aspect of your compensation, don't hesitate to reach out to your HR department or a trusted financial advisor. They can provide guidance and support to ensure you fully understand your earnings and make the most of your Walmart employment.

💡 Note: Remember, understanding your paystub is crucial for financial well-being. Take the time to review and analyze your paystub regularly to stay informed and make informed decisions about your earnings and benefits.

Conclusion

Decoding your Walmart paystub is an essential skill for managing your finances effectively. By following these 18 tips, you can gain a comprehensive understanding of your earnings, deductions, and contributions. Regularly reviewing your paystub ensures accuracy, empowers you to make informed financial choices, and maximizes the value of your Walmart employment. Stay organized, seek assistance when needed, and take control of your financial future.

How often does Walmart issue paystubs?

+

Walmart typically issues paystubs on a bi-weekly basis, coinciding with payday. However, pay frequencies may vary depending on your position and employment agreement.

Can I access my paystub online?

+

Yes, Walmart provides an online portal where employees can access their paystubs and other important employment documents. Log in to your employee account to view and download your paystub.

What should I do if I notice errors on my paystub?

+

If you identify any errors or discrepancies on your paystub, promptly contact your HR department or payroll team. They can investigate the issue and make the necessary corrections to ensure accurate payment and record-keeping.

How can I maximize my retirement savings through Walmart’s 401(k) plan?

+

To maximize your retirement savings, consider contributing the maximum amount allowed by the plan. Walmart may offer matching contributions, so taking advantage of this opportunity can significantly boost your retirement savings. Consult with a financial advisor to determine the best contribution strategy for your goals.

Are there any tax benefits associated with Walmart’s benefits package?

+

Yes, certain components of Walmart’s benefits package, such as retirement savings plans and pre-tax insurance premiums, offer tax advantages. These deductions reduce your taxable income, potentially lowering your tax liability. Consult with a tax professional to fully understand the tax benefits available to you.