Taking control of your finances is an essential step towards achieving financial freedom and stability. One crucial aspect of financial management is understanding and calculating your living expenses. By mastering your living expense calculator, you can gain a clear picture of your financial situation and make informed decisions to optimize your budget. In this guide, we will walk you through the process of creating a comprehensive living expense calculator in just 20 minutes, empowering you to take control of your finances today.

Understanding Living Expenses

Living expenses encompass all the costs associated with maintaining your everyday life. These expenses can be categorized into two main types: fixed and variable.

Fixed Expenses

Fixed expenses are those that remain relatively constant from month to month. They include essential costs such as:

- Rent or mortgage payments

- Insurance premiums (e.g., health, life, or home insurance)

- Internet and utility bills (e.g., electricity, water, and gas)

- Loan repayments (e.g., student loans or car loans)

- Subscription services (e.g., gym memberships or streaming services)

Variable Expenses

Variable expenses, on the other hand, can fluctuate from month to month. These expenses include:

- Groceries and dining out

- Transportation costs (e.g., gas, public transport, or ride-sharing)

- Entertainment and leisure activities

- Clothing and personal care

- Unexpected expenses (e.g., medical bills or car repairs)

Creating Your Living Expense Calculator

Now that we have a clear understanding of living expenses, let's dive into the process of creating your own living expense calculator. Follow these steps to get started:

Step 1: Gather Your Expense Data

The first step is to collect all the necessary information about your expenses. Start by gathering your recent bank statements, credit card bills, and any other financial records. Identify and categorize your expenses into fixed and variable categories.

Step 2: Calculate Average Monthly Expenses

Next, calculate the average monthly cost for each expense category. For fixed expenses, simply divide the total annual cost by 12. For variable expenses, calculate the average by adding up the costs for the past few months and dividing by the number of months.

For example, if your monthly grocery bill for the past three months was $300, $350, and $400, your average monthly grocery expense would be ($300 + $350 + $400) / 3 = $350.

Step 3: Create a Living Expense Calculator

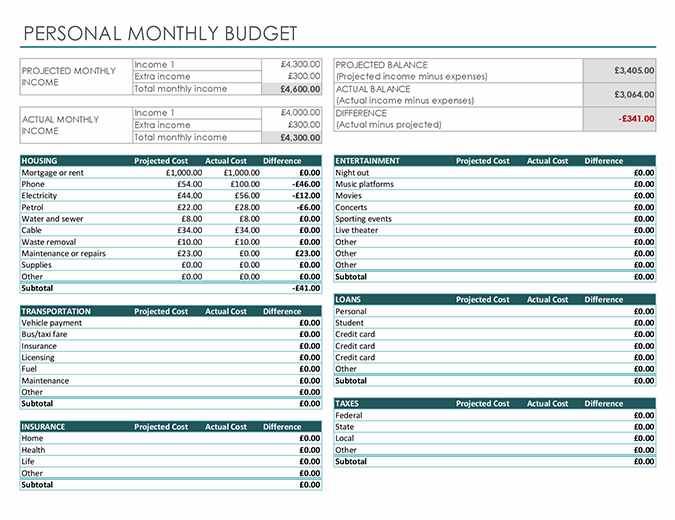

Now, it's time to create your living expense calculator. You can use a simple spreadsheet program like Microsoft Excel or Google Sheets to build your calculator. Here's a step-by-step guide:

- Open a new spreadsheet and create two columns: "Expense Category" and "Monthly Cost."

- In the "Expense Category" column, list all your fixed and variable expense categories.

- In the "Monthly Cost" column, input the average monthly cost for each category.

- Calculate the total monthly living expenses by summing up all the monthly costs.

Your spreadsheet should look something like this:

| Expense Category | Monthly Cost |

|---|---|

| Rent | $1200 |

| Groceries | $350 |

| Transportation | $200 |

| Utilities | $150 |

| Entertainment | $100 |

| Total Monthly Living Expenses | $1900 |

Step 4: Analyze and Adjust

Once you have your living expense calculator, take some time to analyze your expenses. Identify areas where you may be overspending and look for opportunities to cut back. Consider setting realistic budgets for each expense category to help you stay on track.

Step 5: Track and Update Regularly

Living expense calculators are most effective when updated regularly. Set a reminder to review and update your calculator every month or quarter. This will help you stay on top of any changes in your expenses and ensure your financial plan remains accurate.

Tips for Optimizing Your Living Expense Calculator

Here are some additional tips to enhance your living expense calculator and make it work for you:

- Break down variable expenses further: Divide variable expenses into subcategories to gain a deeper understanding of your spending habits. For example, you can separate groceries into "produce," "dairy," and "non-perishables."

- Use color-coding: Highlight fixed expenses in one color and variable expenses in another to quickly identify different expense types.

- Add formulas for total calculations: Create formulas to automatically calculate the total monthly living expenses and the total for each expense category.

- Set budget thresholds: Define budget thresholds for each category to receive alerts when you exceed your planned spending.

- Include savings goals: Allocate a portion of your income to savings goals, such as an emergency fund or retirement savings, and track your progress.

Conclusion

Mastering your living expense calculator is a powerful tool for taking control of your finances. By understanding your expenses, creating a comprehensive calculator, and regularly updating it, you can make informed decisions about your spending and saving habits. Remember, financial management is an ongoing process, so stay committed to reviewing and optimizing your calculator to achieve your financial goals.

FAQ

How often should I update my living expense calculator?

+

It is recommended to update your calculator at least once a month or whenever there are significant changes in your expenses. Regular updates ensure that your financial plan remains accurate and up-to-date.

Can I use a mobile app for my living expense calculator?

+

Yes, there are several mobile apps available that can help you track and manage your living expenses. These apps often offer convenient features like expense tracking, budgeting tools, and visual representations of your spending.

What if I have irregular income or expenses?

+

If your income or expenses are irregular, you can still create a living expense calculator. Simply calculate your average monthly income and expenses over a longer period, such as six months or a year, to get a more accurate representation of your financial situation.

How can I reduce my living expenses?

+To reduce your living expenses, start by identifying areas where you can cut back, such as dining out or entertainment. Consider negotiating lower rates for your fixed expenses, like insurance or internet plans. Additionally, explore cost-saving alternatives, such as cooking at home instead of eating out or using public transport instead of driving.

Is it necessary to include savings in my living expense calculator?

+Yes, including savings in your living expense calculator is crucial. Savings are an essential part of your financial plan, and allocating a portion of your income to savings goals helps you build financial security and achieve long-term financial goals.