Stock analysis is an essential tool for investors looking to make informed decisions and navigate the complex world of the stock market. Creating a comprehensive analysis sheet can be a game-changer, providing a structured approach to evaluating potential investments. In this guide, we will walk you through the process of building an ultimate stock analysis sheet, step by step.

Step 1: Define Your Objectives

Before diving into the creation of your analysis sheet, it's crucial to define your investment goals and objectives. Ask yourself: What are you hoping to achieve through stock analysis? Are you looking for long-term growth, short-term gains, or a balanced portfolio? Understanding your objectives will guide the entire process and help you tailor your analysis sheet accordingly.

Step 2: Gather Essential Data

Stock analysis relies on a vast array of data points. Begin by collecting fundamental information about the company, such as its industry, products or services, competitors, and market position. Financial statements, including income statements, balance sheets, and cash flow statements, are vital for assessing a company's financial health. Additionally, keep an eye on economic indicators, industry trends, and news that could impact the stock's performance.

Step 3: Choose Your Analysis Tools

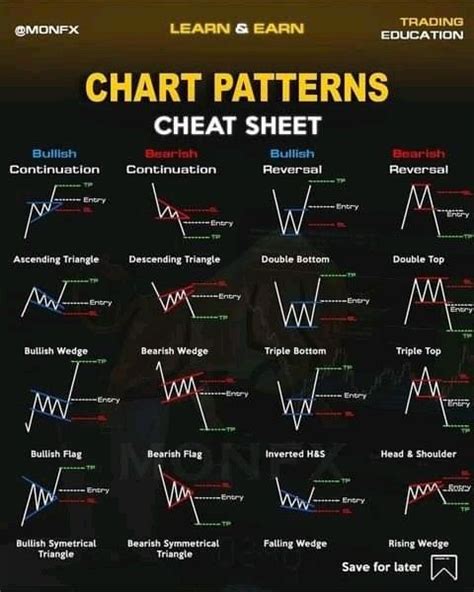

There are numerous tools and techniques available for stock analysis. Some popular methods include fundamental analysis, technical analysis, and quantitative analysis. Fundamental analysis focuses on a company's financial health and business fundamentals, while technical analysis utilizes charts and historical price data to predict future price movements. Quantitative analysis employs mathematical models and algorithms to make investment decisions. Choose the tools that align with your objectives and expertise.

Step 4: Create a Structured Template

Designing a well-organized template is key to an effective analysis sheet. Start by dividing your sheet into sections, each focusing on a specific aspect of analysis. Common sections include company overview, financial analysis, valuation, risk assessment, and recommendations. Within each section, create subsections to further break down the information. For instance, the financial analysis section might include subsections for revenue growth, profitability, and debt analysis.

Step 5: Input Data and Perform Calculations

With your template ready, it's time to input the gathered data. Ensure that you have accurate and up-to-date information. Perform calculations and ratios specific to your chosen analysis methods. For example, calculate the price-to-earnings (P/E) ratio, return on equity (ROE), or other relevant metrics. These calculations will provide valuable insights into the company's performance and potential.

Step 6: Interpret and Analyze

Once the data is input and calculations are complete, it's time to interpret the results. Compare the calculated ratios and metrics to industry averages and historical data. Look for trends, patterns, and anomalies that could indicate potential opportunities or risks. Consider the overall market conditions and how they might impact the stock's performance. This step requires critical thinking and a deep understanding of the analysis tools you've chosen.

Step 7: Make Informed Decisions

With your analysis sheet complete, you're now equipped to make informed investment decisions. Based on your findings, determine whether the stock aligns with your investment objectives. Consider the potential risks and rewards, and decide whether to buy, sell, or hold the stock. Remember, stock analysis is an ongoing process, and regular updates to your analysis sheet are essential to stay informed and adapt to market changes.

Additional Tips and Notes

💡 Note: While creating an analysis sheet is a powerful tool, it's essential to approach stock analysis with caution. Market conditions can change rapidly, and no analysis can predict the future with absolute certainty. Diversify your portfolio, manage risks, and stay updated with market news and trends.

📊 Note: Consider using online platforms or software specifically designed for stock analysis. These tools can automate calculations, provide real-time data, and offer additional insights through advanced analytics.

📈 Note: Remember that stock analysis is an art as much as it is a science. Develop your analytical skills, stay informed, and continuously learn from market experts to enhance your decision-making abilities.

Conclusion

Creating an ultimate stock analysis sheet is a valuable endeavor for investors seeking to make informed choices. By following these seven steps, you can develop a comprehensive and structured approach to evaluating stocks. Remember, successful investing is a combination of thorough analysis, risk management, and staying adaptable to market dynamics. With your analysis sheet as a guide, you'll be better equipped to navigate the stock market and make decisions aligned with your investment goals.

FAQ

What is the most important aspect of stock analysis?

+

Understanding a company’s financial health and market position is crucial. Focus on fundamental analysis to evaluate these aspects thoroughly.

How often should I update my analysis sheet?

+

Regular updates are essential. Aim to review and update your sheet at least quarterly or whenever significant market events occur.

Can stock analysis guarantee profitable investments?

+

While stock analysis provides valuable insights, it cannot guarantee profits. Market dynamics are complex, and risks are inherent. Diversification and risk management are key.

Are there any free resources for stock analysis?

+

Yes, there are several free online platforms and resources that offer basic stock analysis tools and data. However, paid platforms often provide more advanced features and real-time data.

How can I improve my stock analysis skills?

+

Continuous learning is key. Read books, follow market experts, attend webinars, and stay updated with the latest trends and analysis techniques. Practice makes perfect, so analyze various stocks and learn from your experiences.