Financial independence and stability are crucial aspects of life, and having a livable wage is essential to achieving them. A livable wage, also known as a living wage, ensures that individuals can meet their basic needs and have a decent standard of living. In today's fast-paced world, where the cost of living continues to rise, it's important to take control of your financial future. Here are seven expert tips to help you create your livable wage and secure a brighter financial future.

1. Define Your Financial Goals

The first step towards creating your livable wage is to define your financial goals. Take some time to reflect on your short-term and long-term financial aspirations. Do you want to save for a dream vacation, pay off debts, or invest in your future? Understanding your financial goals will help you determine the amount of income you need to achieve them.

2. Calculate Your Expenses

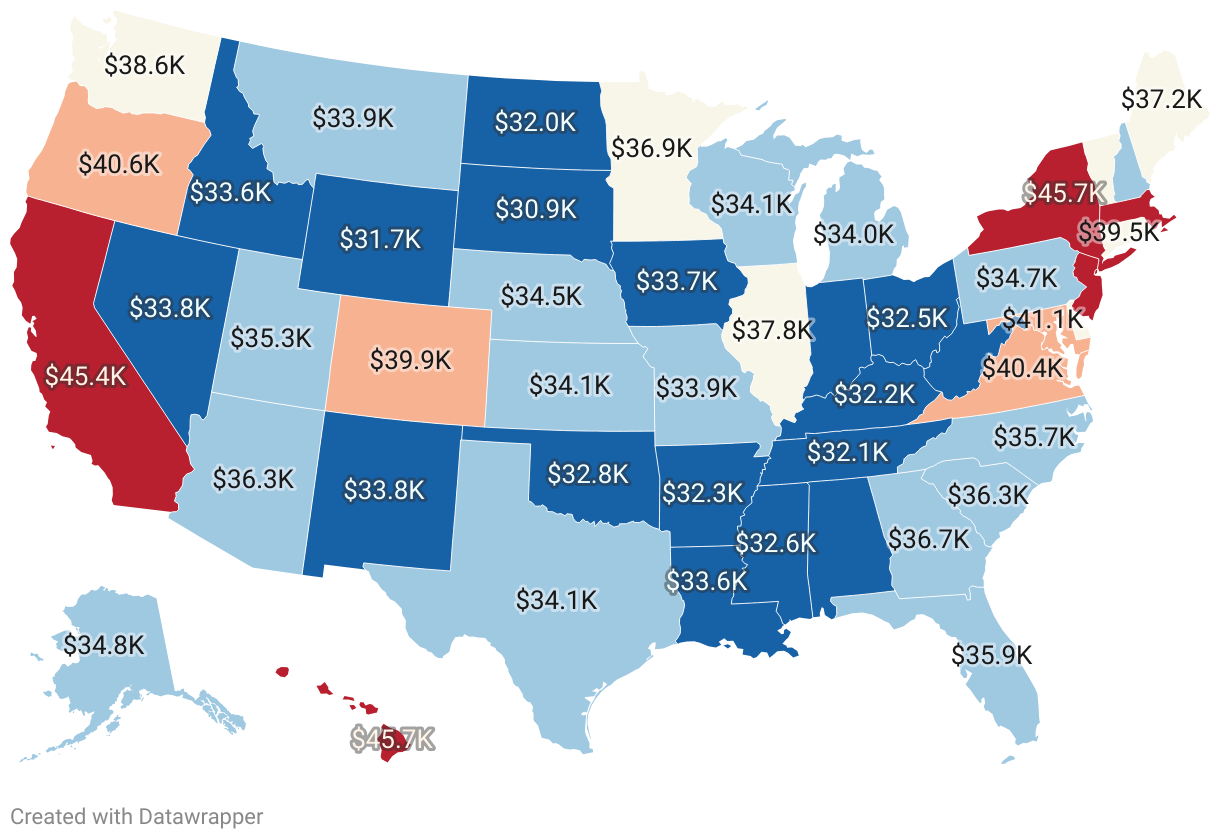

To determine your livable wage, you need to have a clear understanding of your expenses. Create a comprehensive budget that outlines your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, insurance, and any other regular outgoings. Be sure to include occasional expenses like holidays or car maintenance. By calculating your expenses, you can set a realistic income target.

3. Explore Multiple Income Streams

Relying solely on a single source of income can be risky, especially in today's uncertain economic climate. Consider exploring multiple income streams to increase your earning potential and create a more stable financial situation. Here are some ideas to get you started:

- Freelancing or consulting in your area of expertise

- Starting an online business or selling products/services online

- Renting out a spare room or property

- Investing in stocks, bonds, or other financial instruments (with caution)

- Taking on part-time jobs or gig work

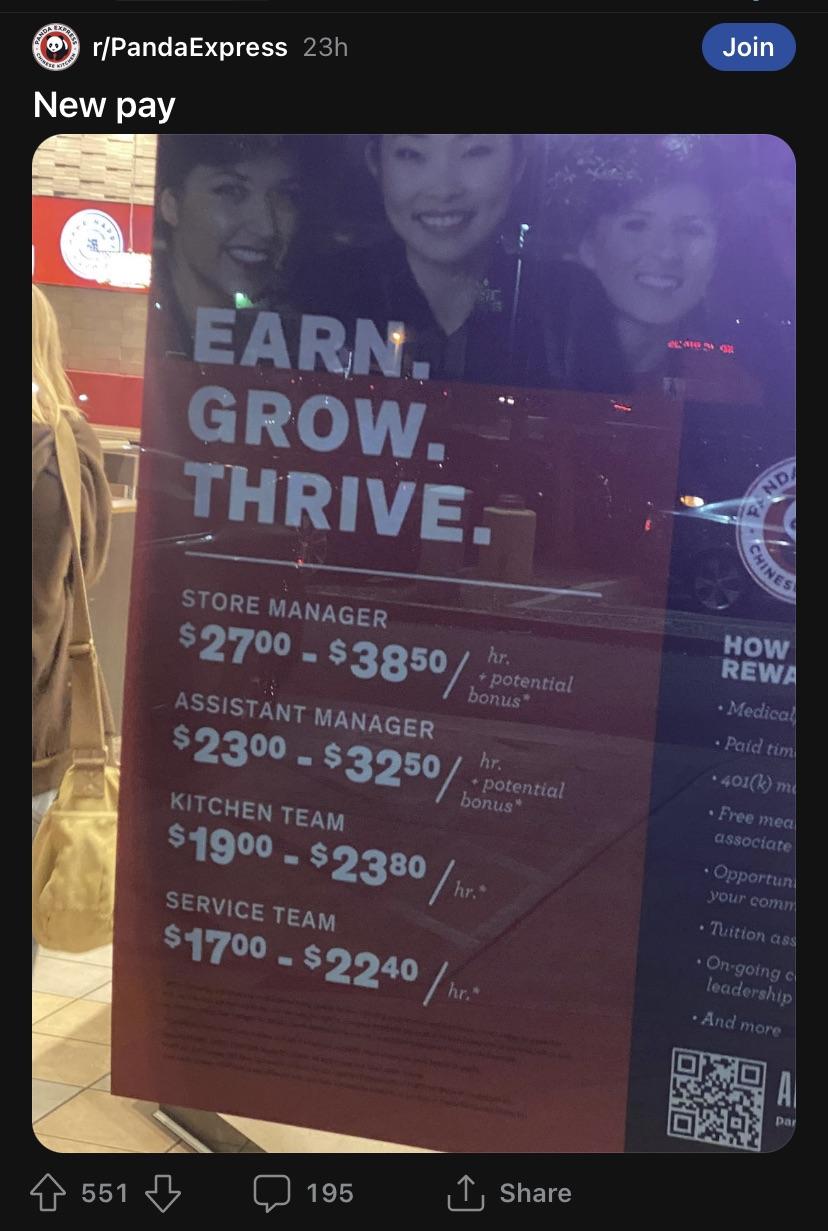

4. Negotiate for Higher Pay

If you feel that your current salary is not meeting your livable wage requirements, it's time to negotiate for higher pay. Many employers are open to discussing salary increases, especially if you can demonstrate your value to the company. Highlight your achievements, take on additional responsibilities, and show your commitment to the organization. Be prepared with data and research to support your request for a raise.

5. Develop New Skills

In today's competitive job market, continuous learning and skill development are essential. Investing in yourself by acquiring new skills can open doors to higher-paying job opportunities. Consider taking online courses, attending workshops, or pursuing certifications in your field. Stay up-to-date with industry trends and technologies to make yourself a valuable asset in the job market.

6. Optimize Your Spending

While increasing your income is crucial, optimizing your spending habits is equally important. Review your budget regularly and look for areas where you can cut back on unnecessary expenses. Here are some tips to help you save money:

- Cook at home instead of eating out frequently

- Shop around for better deals on insurance, internet, and phone plans

- Reduce subscription services you may not be utilizing fully

- Opt for energy-efficient appliances and practices to lower utility bills

- Consider carpooling or using public transportation to save on fuel costs

7. Build an Emergency Fund

Unexpected expenses can arise at any time, and having an emergency fund is crucial to maintaining your livable wage. Aim to save at least three to six months' worth of living expenses in a readily accessible account. This fund will provide a safety net during unforeseen circumstances, such as medical emergencies, car repairs, or temporary unemployment. Start small and make regular contributions to build up your emergency fund.

Frequently Asked Questions

How much should I save for an emergency fund?

+

Financial experts recommend saving three to six months' worth of living expenses for your emergency fund. This fund will provide a financial cushion during unexpected situations.

What are some ways to negotiate for a higher salary?

+

When negotiating for a higher salary, it's important to research industry standards and average salaries for your position. Highlight your achievements, take on additional responsibilities, and demonstrate your value to the company. Be prepared with data and be open to discussing your career goals and aspirations.

How can I develop new skills to increase my earning potential?

+

There are numerous ways to develop new skills. Consider taking online courses, attending workshops or conferences, or pursuing certifications in your field. Stay updated with industry trends and technologies to stay competitive in the job market. Networking and seeking mentorship can also provide valuable insights and opportunities for skill development.

💰 Note: Remember, creating your livable wage is a journey, and it may take time and effort. Stay persistent, and don’t be afraid to seek guidance from financial advisors or career counselors. With the right strategies and a proactive approach, you can achieve financial stability and a brighter future.