In a significant move, Walmart, the retail giant, has announced a stock split, creating a ripple effect in the market and presenting investors with new opportunities. This article explores six strategic ways to capitalize on this development, providing a comprehensive guide to navigating the post-split landscape.

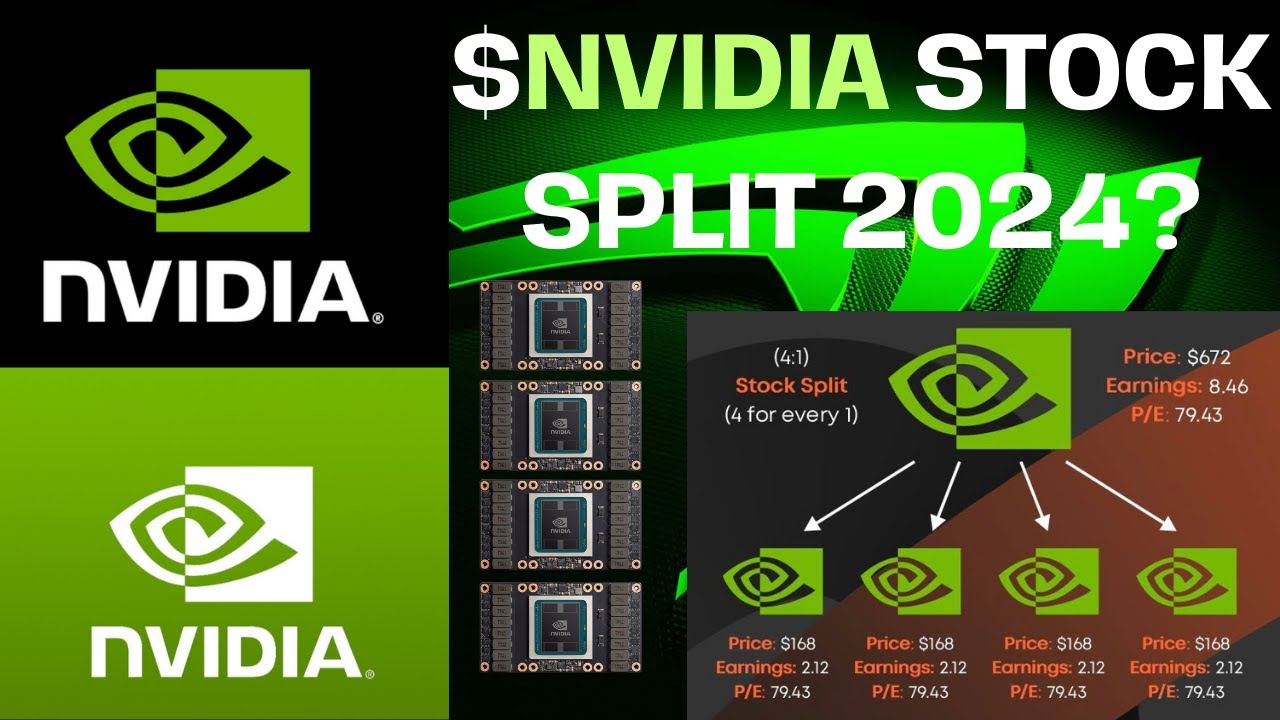

1. Understand the Basics: What is a Stock Split and Why Does it Matter?

A stock split is a corporate action where a company increases the number of its outstanding shares, thereby reducing the price per share. It's a strategy employed by companies to make their stocks more affordable and accessible to a wider range of investors. For Walmart, this move aims to boost liquidity and potentially attract new investors.

The key takeaway is that a stock split doesn't change the company's market capitalization or the total value of your investment. It merely adjusts the number of shares and their price. However, it can impact investor psychology and market sentiment, creating potential trading opportunities.

2. Take Advantage of the Initial Price Drop

Following a stock split, it's common for the share price to dip initially. This presents a buying opportunity for investors, especially those who believe in the long-term prospects of the company. Walmart's stock split could result in a temporary price decrease, offering a chance to acquire more shares at a potentially lower cost.

However, it's crucial to exercise caution and conduct thorough research. Not all stocks perform well post-split, and market dynamics can vary. Consider factors like Walmart's financial health, growth prospects, and industry trends before making any investment decisions.

3. Explore Dividend Strategies

Walmart is known for its dividend payments, and the stock split could influence dividend strategies. Consider the following approaches:

- Dividend Reinvestment Plans (DRIPs): Enrolling in a DRIP allows you to automatically reinvest your dividends to purchase more shares. This strategy can help grow your investment over time, especially with the increased share availability post-split.

- Dividend Capture: If you're a short-term investor, you might consider buying Walmart stock just before the ex-dividend date and selling it shortly after receiving the dividend. This strategy can provide a quick return, but it's important to note that dividend capture carries risks and may not always be profitable.

4. Leverage Options Trading

For more advanced investors, options trading can be a powerful tool to profit from the stock split. Here's how:

- Call Options: Buying call options gives you the right to purchase Walmart stock at a specific price (strike price) within a defined period. If the stock price rises significantly post-split, call options can provide substantial returns.

- Put Options: Put options grant you the right to sell Walmart stock at a specified price. They can be useful if you anticipate a temporary price drop post-split and want to protect your investment or profit from the decline.

Remember, options trading involves higher risk due to the time-sensitive nature of options contracts and the potential for significant losses. It's essential to have a solid understanding of options and market dynamics before engaging in this strategy.

5. Consider Long-Term Investment

If you're a long-term investor, Walmart's stock split could be an opportunity to deepen your commitment to the company. Here's why:

- Historical Performance: Walmart has a track record of delivering solid returns over the long term. A stock split doesn't change this fundamental aspect of the company.

- Dividend Growth: With a larger number of shares outstanding, Walmart might consider increasing its dividend payments. This could lead to a higher total dividend income for long-term investors.

- Market Share and Expansion: Walmart is a dominant player in the retail industry. Its stock split could be a strategic move to enhance its competitive position and attract new investors, potentially driving long-term growth.

6. Diversify with Walmart-Related Investments

Beyond direct investment in Walmart stock, consider diversifying your portfolio with related investments:

- Suppliers and Partners: Invest in companies that supply goods to Walmart or have strong partnerships with the retail giant. These companies might benefit from Walmart's growth and expanded share price.

- Retail ETFs: Exchange-Traded Funds (ETFs) focused on the retail sector can provide exposure to a basket of retail stocks, including Walmart. This approach diversifies risk and offers a broader perspective on the industry.

- Real Estate Investment Trusts (REITs): Walmart's physical stores and distribution centers are significant assets. Investing in REITs that own retail properties can provide an indirect link to Walmart's success.

Notes:

🌟 Note: Always conduct thorough research and consult financial advisors before making investment decisions. The stock market carries risks, and past performance is not indicative of future results.

💰 Note: Options trading involves substantial risk and is suitable only for experienced investors. Ensure you understand the risks and have adequate capital to cover potential losses.

📈 Note: Long-term investment strategies require patience and a commitment to weather market fluctuations. Diversification is key to managing risk and maximizing returns.

In conclusion, Walmart's stock split presents a unique set of opportunities for investors. By understanding the fundamentals, leveraging market dynamics, and exploring various investment strategies, you can position yourself to profit from this corporate action. Remember, a comprehensive understanding of the market and your investment goals is essential for successful investing.

FAQ

What is a stock split, and how does it work?

+

A stock split is a corporate action where a company increases the number of its outstanding shares, thereby reducing the price per share. It’s a strategy to make stocks more affordable and accessible to investors. For example, a 2-for-1 stock split doubles the number of shares, halving the price per share.

Why do companies split their stocks?

+

Companies split their stocks to make them more affordable and appealing to a broader range of investors. It can also improve liquidity and market perception, potentially driving up the stock price over time.

How does a stock split impact my existing investment in Walmart?

+

A stock split doesn’t change the value of your investment. If you owned 100 shares of Walmart stock at 100 each before the split, you would own 200 shares at 50 each after a 2-for-1 split. The total value of your investment remains the same.