Understanding APR and Its Importance

The Annual Percentage Rate (APR) is a crucial metric used to determine the true cost of borrowing money. It represents the yearly interest rate on loans, credit cards, or other financial products, including any additional fees or charges. Understanding how to calculate APR accurately is essential for both borrowers and lenders, as it provides a clear indication of the total cost associated with borrowing.

Why Calculate APR in Excel?

Excel, with its powerful calculation capabilities, is an excellent tool for financial analysis. By calculating APR in Excel, you gain several advantages:

- Precision: Excel ensures precise calculations, reducing the risk of errors that may occur with manual calculations.

- Efficiency: Automated calculations save time and effort, allowing you to focus on interpreting the results.

- Flexibility: Excel’s flexibility enables you to customize formulas and analyze various scenarios, providing valuable insights.

Step-by-Step Guide to Calculating APR in Excel

Step 1: Gather Necessary Information

Before calculating APR, ensure you have the following information:

- Loan Amount: The total amount borrowed.

- Interest Rate: The annual interest rate applied to the loan.

- Loan Term: The duration of the loan, usually in years or months.

- Fees: Any additional fees or charges associated with the loan.

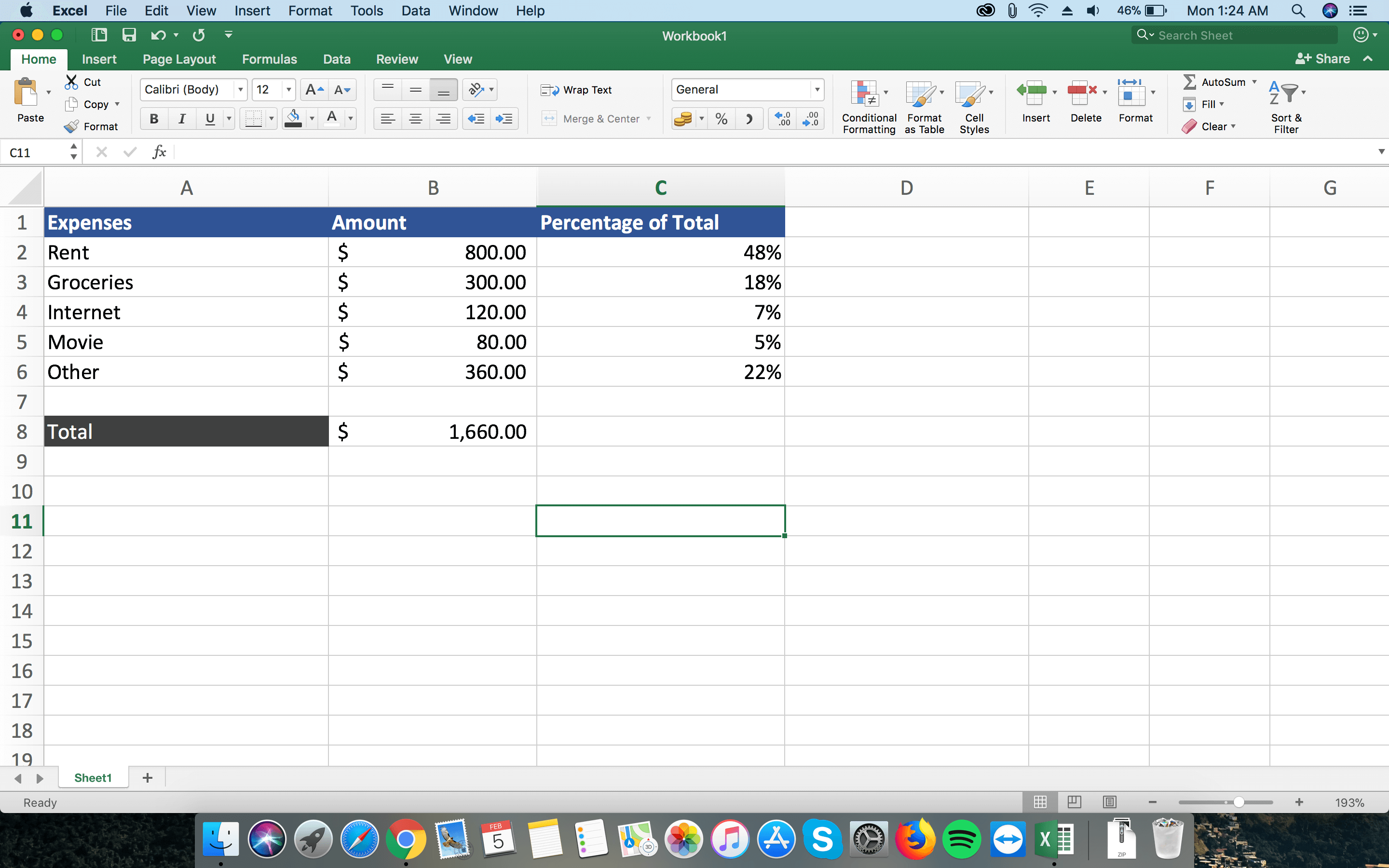

Step 2: Prepare Your Excel Worksheet

Set up your Excel worksheet with the following columns:

- Loan Amount

- Interest Rate

- Loan Term

- Fees

- APR (where you will calculate the APR)

Step 3: Enter the Data

Input the loan amount, interest rate, loan term, and fees into the respective columns. Ensure that the interest rate and fees are entered as percentages (e.g., 5% for an interest rate of 5%).

Step 4: Calculate APR

To calculate the APR, use the following formula in the “APR” column:

=RATES(Number of Payments per Year, Periodic Payment, Present Value, Future Value, Type)

- Number of Payments per Year: This is the number of payments made per year. For monthly payments, enter 12.

- Periodic Payment: The amount paid each period. For loans with equal payments, this is usually 0.

- Present Value: The initial loan amount.

- Future Value: The final loan balance after the last payment. For loans that are fully paid off, this is usually 0.

- Type: Specifies when payments are due. Enter 0 for the end of the period or 1 for the beginning of the period.

Step 5: Interpret the Results

The calculated APR represents the true cost of borrowing for the given loan. Compare this APR with other financial products to make informed decisions.

Example Scenario

Let’s consider an example to illustrate the APR calculation process:

- Loan Amount: $10,000

- Interest Rate: 5%

- Loan Term: 5 years (60 months)

- Fees: $500

Calculation:

Using the formula:

=RATES(12, 0, -10000, 0, 0)

This formula calculates the APR for a loan with the provided details.

Advanced APR Calculations

For more complex loans with varying payment amounts or additional fees, you can use the XIRR function in Excel. This function allows you to input a range of values for payments and dates, providing a more accurate APR calculation.

Notes:

- Always ensure that your data is entered accurately to avoid calculation errors.

- Consider the impact of compounding interest on the APR calculation.

- Remember that APR calculations may vary based on the specific loan terms and conditions.

Conclusion:

Calculating APR in Excel empowers you to make informed financial decisions. By understanding the true cost of borrowing, you can compare different loan options and choose the most suitable one for your needs. Excel’s powerful features make it an invaluable tool for accurate and efficient APR calculations.

FAQ:

What is the difference between APR and interest rate?

+

The interest rate represents the cost of borrowing money, typically expressed as a percentage. APR, on the other hand, includes the interest rate plus any additional fees or charges, providing a more comprehensive view of the cost of borrowing.

Can I use Excel to compare APR across different loans?

+

Absolutely! Excel’s calculation capabilities allow you to input various loan details and compare the calculated APRs side by side. This makes it easier to identify the most cost-effective loan option.

Are there any limitations to calculating APR in Excel?

+

While Excel provides accurate calculations, it’s important to note that some loans may have unique terms or structures that require specialized financial software for precise APR calculations. For straightforward loans, Excel is an excellent choice.