Understanding Payback in Excel

Payback is a financial metric used to evaluate the time it takes for an investment to recover its initial cost. It provides insight into the liquidity and risk associated with a project or investment. In Excel, you can calculate the payback period with ease, allowing you to make informed decisions about your financial endeavors. This guide will walk you through the process of calculating payback in Excel, offering a comprehensive understanding of the formula and its applications.

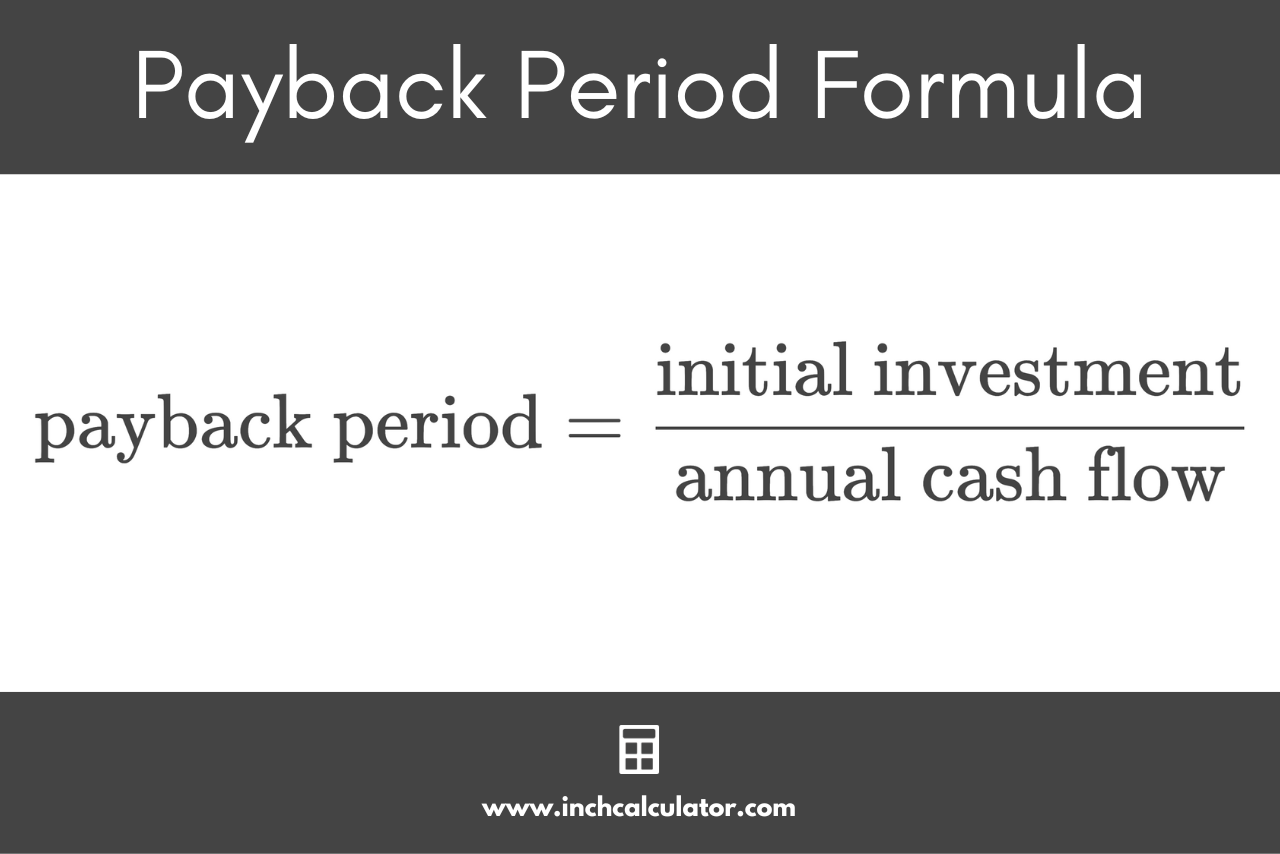

The Payback Formula

The payback formula in Excel is relatively straightforward:

Payback Period = Initial Investment / Cash Flow per Period

Here’s a breakdown of the components:

- Initial Investment: This is the total amount of money invested in the project or business venture. It could include the cost of assets, equipment, or any other expenses required for the investment.

- Cash Flow per Period: This represents the net cash inflow or outflow generated by the investment over a specific period. It is essential to consider the timing of these cash flows, as they can significantly impact the payback period.

Step-by-Step Guide to Calculating Payback in Excel

Prepare Your Data:

- Begin by organizing your data in Excel. Create columns for the initial investment, cash flows, and any other relevant financial information.

- Ensure that your cash flow data is structured with the earliest cash flows at the top and subsequent periods below.

Calculate Cash Flows:

- If your cash flows are not already calculated, determine the net cash flow for each period. This involves subtracting expenses from revenues for each period.

- You can use a simple formula like “= Revenue - Expenses” to calculate the cash flow for each period.

Enter the Initial Investment:

- In a separate cell, enter the initial investment amount. This value should be a negative number to represent the outflow of cash.

Calculate Payback Period:

- In a new cell, enter the formula for the payback period. For example:

=INITIAL_INVESTMENT / CASH_FLOW_PER_PERIOD - Replace

INITIAL_INVESTMENTwith the cell reference containing the initial investment amount, andCASH_FLOW_PER_PERIODwith the cell reference for the cash flow in the first period.

- In a new cell, enter the formula for the payback period. For example:

Copy the Formula:

- Select the cell containing the payback period formula.

- Drag the fill handle (the small square in the bottom-right corner of the selected cell) down to apply the formula to the remaining periods.

- Excel will automatically adjust the cell references to calculate the payback period for each period.

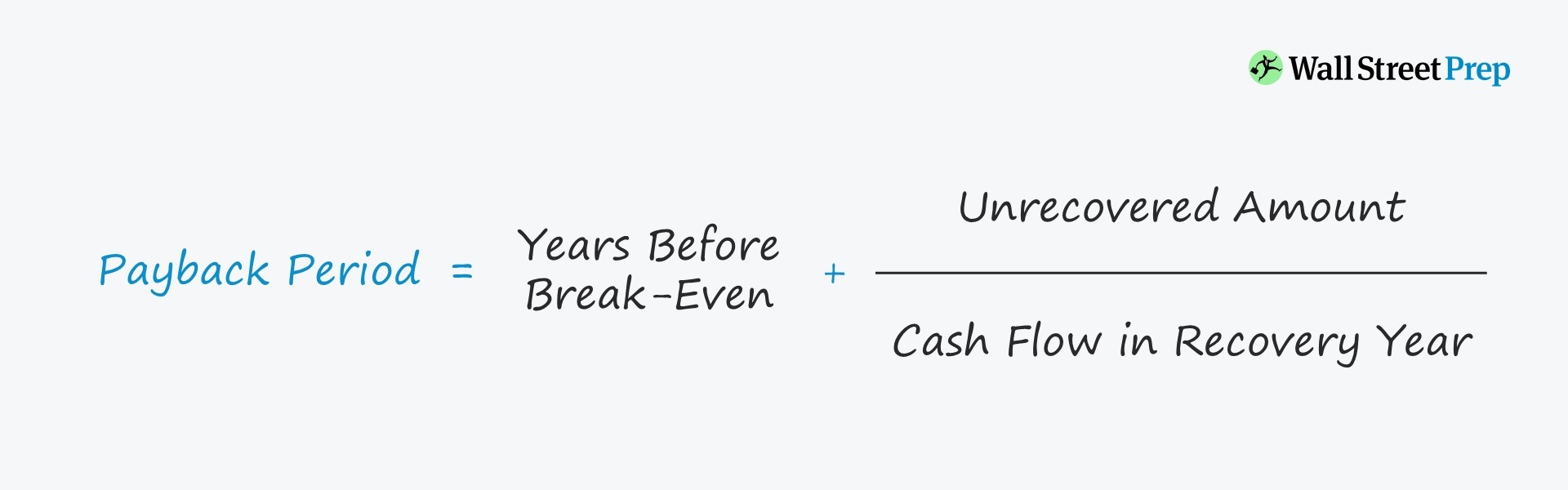

Identify the Payback Period:

- The payback period is the point at which the cumulative cash flows equal the initial investment.

- Look for the first period where the cumulative cash flows are greater than or equal to the initial investment. This period represents the payback period.

Example: Calculating Payback for a New Business Venture

Let’s consider an example to illustrate the calculation of payback in Excel. Imagine you are investing in a new business venture with the following cash flows:

| Period | Cash Flow |

|---|---|

| 1 | $10,000 |

| 2 | $15,000 |

| 3 | $20,000 |

| 4 | $25,000 |

| 5 | $30,000 |

Your initial investment for this venture is $50,000.

Step 1: Prepare Your Data

| Period | Cash Flow |

|---|---|

| 1 | $10,000 |

| 2 | $15,000 |

| 3 | $20,000 |

| 4 | $25,000 |

| 5 | $30,000 |

| Initial Investment | -$50,000 |

Step 2: Calculate Cash Flows (if not already done)

No additional calculation is needed as the cash flows are provided.

Step 3: Enter the Initial Investment

Enter -$50,000 in the “Initial Investment” cell.

Step 4: Calculate Payback Period

In a new cell, enter the formula:

= -$50,000 / $10,000

Step 5: Copy the Formula

Drag the fill handle down to apply the formula to the remaining periods.

Step 6: Identify the Payback Period

The payback period is reached when the cumulative cash flows exceed the initial investment. In this case, it occurs at the end of period 3:

| Period | Cash Flow | Payback Period | Cumulative Cash Flows |

|---|---|---|---|

| 1 | $10,000 | 5 | $10,000 |

| 2 | $15,000 | 3.33 | $25,000 |

| 3 | $20,000 | 2.5 | $55,000 |

| 4 | $25,000 | 2 | $80,000 |

| 5 | $30,000 | 1.67 | $110,000 |

Notes:

🚨 Note: Payback period calculation assumes that cash flows are regular and consistent. If your cash flows vary significantly, you may need to adjust your calculations or use alternative methods.

💡 Tip: Consider using the IRR (Internal Rate of Return) function in Excel for more complex investment evaluations, as it takes into account the time value of money and provides a more comprehensive analysis.

Conclusion

Calculating payback in Excel is a valuable skill for financial analysis and decision-making. By understanding the payback formula and following the step-by-step guide provided, you can assess the liquidity and risk of your investments effectively. Remember to consider the limitations and assumptions of the payback method and explore other financial metrics for a comprehensive evaluation of your projects or investments.

FAQ

Can I use Excel to calculate payback for irregular cash flows?

+

While the payback formula assumes regular cash flows, you can adjust your calculations to account for irregular cash flows. This may involve creating a more complex formula or using Excel’s built-in functions like SUMIF or SUMIFS to calculate cumulative cash flows.

What if my cash flows are negative in some periods?

+

Negative cash flows can impact the payback period calculation. Ensure that you account for these negative flows by including them in your cumulative cash flow calculations. The payback period will be reached when the cumulative cash flows, including negative values, equal the initial investment.

Is the payback period the same as the break-even point?

+

No, the payback period and break-even point are different concepts. The payback period refers to the time it takes to recover the initial investment, while the break-even point is the point where total revenues equal total expenses, indicating that the business is no longer incurring a loss.