Introduction to Sharpe Ratio

The Sharpe ratio is a widely used measure in finance to assess the performance of an investment or portfolio relative to its risk. It helps investors evaluate the excess return earned in relation to the risk taken, providing valuable insights into the efficiency of an investment strategy. Calculating the Sharpe ratio involves dividing the excess return of an investment by its standard deviation, allowing for a standardized comparison across different investments.

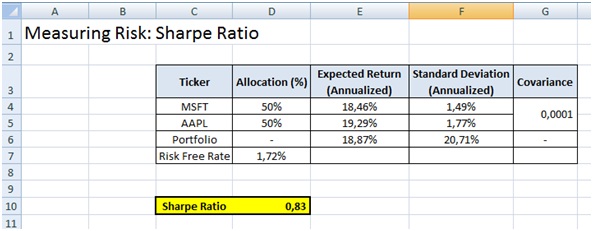

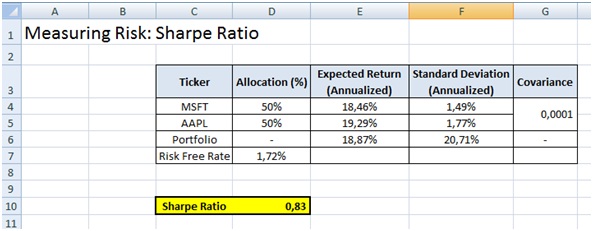

Step-by-Step Guide to Calculating Sharpe Ratio in Excel

Step 1: Gather the Necessary Data

Before diving into the calculation, ensure you have the following data readily available:

- Expected Return: The anticipated return on your investment or portfolio.

- Risk-Free Rate: The return on a risk-free investment, such as a government bond.

- Standard Deviation: The measure of volatility or risk associated with your investment or portfolio.

Step 2: Prepare Your Excel Worksheet

Open a new Excel worksheet and create a basic structure with the following columns:

- Expected Return

- Risk-Free Rate

- Standard Deviation

- Sharpe Ratio

Step 3: Input Your Data

Enter the expected return, risk-free rate, and standard deviation values into the respective columns. Ensure that the data is accurate and up-to-date.

Step 4: Calculate the Excess Return

To calculate the excess return, subtract the risk-free rate from the expected return. In Excel, you can use the following formula:

= Expected Return - Risk-Free Rate

This formula will give you the excess return, which represents the additional return earned above the risk-free rate.

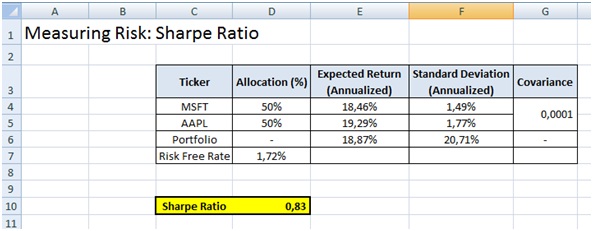

Step 5: Calculate the Sharpe Ratio

Now, it’s time to calculate the Sharpe ratio. Divide the excess return by the standard deviation using the following formula:

= Excess Return / Standard Deviation

This calculation provides you with the Sharpe ratio, which quantifies the risk-adjusted return of your investment or portfolio.

Step 6: Interpret the Sharpe Ratio

The Sharpe ratio helps you evaluate the efficiency of your investment strategy. A higher Sharpe ratio indicates better performance, as it suggests higher returns relative to the risk taken. Conversely, a lower Sharpe ratio may suggest that the investment is not generating returns commensurate with its risk level.

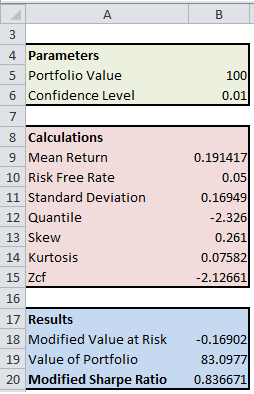

Advanced Techniques for Sharpe Ratio Calculation

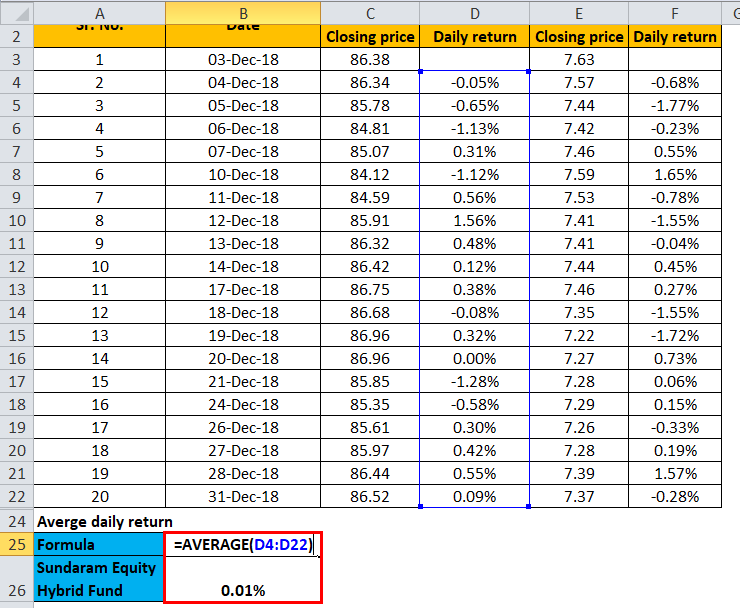

Using Excel Functions

Excel provides a range of functions that can simplify the calculation process. For instance, you can use the STDEV function to calculate the standard deviation and the AVERAGE function to calculate the expected return. These functions automate the process and reduce the chances of errors.

Customizing the Risk-Free Rate

The choice of the risk-free rate can impact the Sharpe ratio calculation. While government bond rates are commonly used, you can customize this rate based on your specific investment context. Consider the prevailing market conditions and the risk-free rate that aligns with your investment strategy.

Adjusting for Time Periods

The Sharpe ratio calculation assumes annualized returns. If your data covers a shorter time period, you may need to adjust the expected return and standard deviation to an annual basis. Excel’s built-in functions, such as STDEVA and AVERAGEA, can assist in annualizing the data.

Visualizing Sharpe Ratio Results

Creating a Scatter Plot

To gain a visual representation of your Sharpe ratio calculation, you can create a scatter plot in Excel. Plot the expected return on the x-axis and the Sharpe ratio on the y-axis. This graph will help you compare different investments or portfolios and identify those with the highest risk-adjusted returns.

Highlighting Critical Values

You can enhance your scatter plot by highlighting critical values. For example, you can use conditional formatting to color-code data points based on their Sharpe ratio values. This visual cue will make it easier to identify investments with the highest potential.

FAQ

What is a good Sharpe ratio?

A Sharpe ratio above 1 is generally considered good, indicating that the investment is generating returns that are higher than the risk-free rate with a relatively low level of risk.

Can the Sharpe ratio be negative?

Yes, the Sharpe ratio can be negative. A negative Sharpe ratio suggests that the investment’s returns are lower than the risk-free rate, indicating that the investment may not be performing well relative to its risk level.

How often should I calculate the Sharpe ratio?

The frequency of calculating the Sharpe ratio depends on your investment strategy and goals. It is recommended to calculate it periodically, such as quarterly or annually, to monitor the performance of your investments over time.

Are there any limitations to the Sharpe ratio?

While the Sharpe ratio is a valuable tool, it has some limitations. It assumes a normal distribution of returns and may not accurately reflect the behavior of complex financial instruments. Additionally, it does not consider the potential for downside risk or the impact of market volatility.

Conclusion

Calculating the Sharpe ratio in Excel is a straightforward process that allows investors to evaluate the performance of their investments or portfolios. By following the step-by-step guide and utilizing Excel’s functions, you can efficiently calculate the Sharpe ratio and make informed investment decisions. Remember to consider the context of your investment and customize the risk-free rate and time periods as needed. Visualizing the results through scatter plots and highlighting critical values can further enhance your analysis. Stay tuned for more insights and strategies to optimize your investment journey!