Understanding WACC

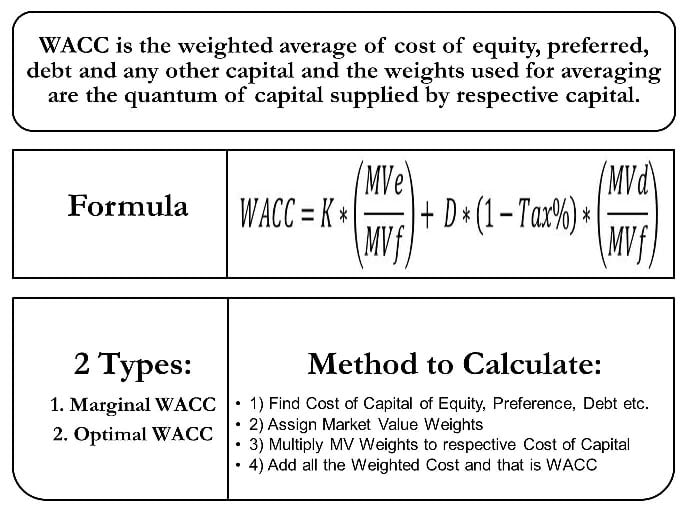

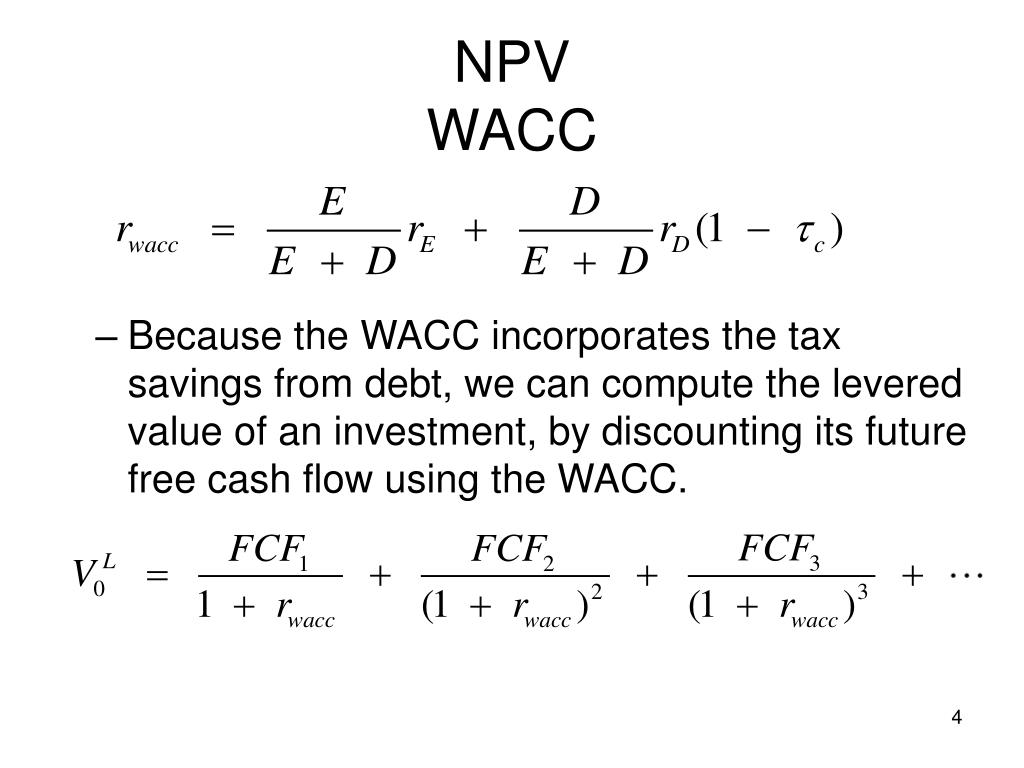

The Weighted Average Cost of Capital (WACC) is a crucial metric in finance and investment analysis. It represents the average rate of return a company must earn on its existing assets to satisfy its investors, taking into account the different sources of financing. WACC is widely used to evaluate the profitability of projects and to determine the discount rate for cash flow analysis.

Calculating WACC involves considering the cost of different sources of capital, such as debt and equity, and weighing them based on their relative proportions in the company’s capital structure. This process ensures that the overall cost of capital reflects the true cost of funding the company’s operations and investments.

Step-by-Step Guide to Calculating WACC in Excel

Step 1: Gather the Necessary Data

Before you begin, collect the following information:

- Market Value of Equity (ME): The total value of the company’s outstanding shares.

- Market Value of Debt (MD): The total value of the company’s outstanding debt, including both short-term and long-term debt.

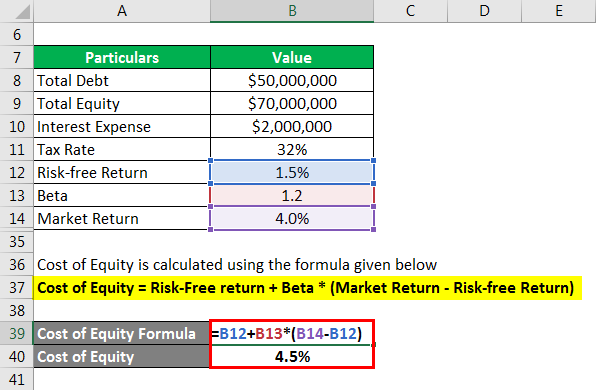

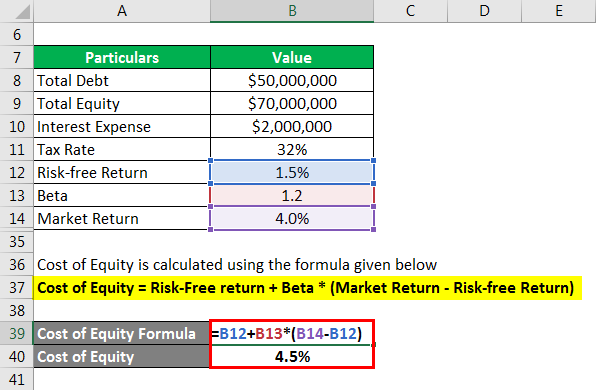

- Cost of Equity (Re): The required rate of return on the company’s equity.

- Cost of Debt (Rd): The interest rate on the company’s debt.

- Corporate Tax Rate (T): The effective tax rate applicable to the company.

Step 2: Calculate the Weight of Each Component

To determine the weight of each component in the WACC calculation, you’ll need to divide the market value of each component by the total market value of all components.

- Weight of Equity (We): Divide the market value of equity (ME) by the sum of the market value of equity and the market value of debt (ME + MD).

- Weight of Debt (Wd): Divide the market value of debt (MD) by the sum of the market value of equity and the market value of debt (ME + MD).

Step 3: Calculate the After-Tax Cost of Debt

The after-tax cost of debt (Rd(1-T)) is calculated by multiplying the cost of debt (Rd) by the corporate tax rate (T). This adjustment accounts for the tax benefits associated with debt financing.

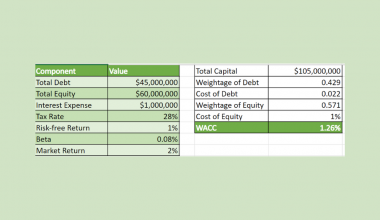

Step 4: Calculate WACC

Now, you can calculate the Weighted Average Cost of Capital (WACC) using the following formula:

WACC = (Weight of Equity * Cost of Equity) + (Weight of Debt * After-Tax Cost of Debt)

Step 5: Validate Your WACC Calculation

It’s essential to validate your WACC calculation to ensure its accuracy. Here’s a simple check:

- Ensure that the sum of the weights of equity and debt equals 1 (We + Wd = 1).

- Verify that the WACC value is within a reasonable range. Typically, WACC ranges from 5% to 15%, but this can vary depending on the industry and the company’s financial health.

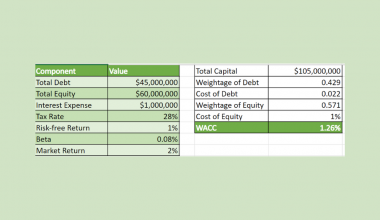

Example WACC Calculation in Excel

Let’s walk through an example to calculate WACC for a hypothetical company, ABC Inc.

| Parameter | Value |

|---|---|

| Market Value of Equity (ME) | $10,000,000 |

| Market Value of Debt (MD) | $5,000,000 |

| Cost of Equity (Re) | 12% |

| Cost of Debt (Rd) | 8% |

| Corporate Tax Rate (T) | 25% |

Step 1: Calculate We and Wd

- We = ME / (ME + MD) = 10,000,000 / (10,000,000 + $5,000,000) = 0.6667

- Wd = MD / (ME + MD) = 5,000,000 / (10,000,000 + $5,000,000) = 0.3333

Step 2: Calculate After-Tax Cost of Debt

- Rd(1-T) = 8% * (1 - 25%) = 6%

Step 3: Calculate WACC

- WACC = (We * Re) + (Wd * Rd(1-T)) = (0.6667 * 12%) + (0.3333 * 6%) = 8.4%

Notes

- Ensure that all values are in the same currency and unit of measurement for consistency.

- If you have multiple sources of debt with different interest rates, calculate the weighted average cost of debt based on the proportion of each debt source.

- WACC is a dynamic metric and should be recalculated periodically to reflect changes in the company’s capital structure and market conditions.

Conclusion

Calculating the Weighted Average Cost of Capital (WACC) in Excel is a valuable skill for financial analysts and investors. By following the step-by-step guide provided, you can accurately determine a company’s cost of capital, which is essential for evaluating investment opportunities and making informed financial decisions. Remember to validate your calculations and stay up-to-date with market trends to ensure the accuracy and relevance of your WACC analysis.

FAQ

What is the significance of WACC in financial analysis?

+

WACC is a crucial metric used to evaluate the profitability of projects and investments. It represents the minimum return a company must achieve to satisfy its investors, taking into account the cost of different sources of capital. WACC is widely used in discounted cash flow (DCF) analysis to determine the appropriate discount rate for future cash flows.

How often should WACC be recalculated?

+

WACC should be recalculated periodically to account for changes in the company’s capital structure, market conditions, and interest rates. It is recommended to update WACC at least annually or whenever there are significant shifts in the company’s financing mix or market environment.

Can WACC be negative?

+In theory, WACC can be negative if the after-tax cost of debt is negative, which could occur in certain tax-advantaged situations. However, in practice, WACC is typically positive, reflecting the cost of capital required to fund a company’s operations and investments.

What are some limitations of using WACC in financial analysis?

+WACC has several limitations. It assumes a static capital structure, which may not reflect the dynamic nature of a company’s financing. Additionally, WACC is an average cost and may not capture the cost of capital for specific projects or investments accurately. It is important to consider project-specific risks and market conditions when evaluating investment opportunities.