Understanding how to calculate the effective interest rate is crucial for making informed financial decisions. In this guide, we will walk you through the steps to compute the effective interest rate using Excel, a powerful tool for financial analysis. By the end of this article, you'll have the knowledge to perform this calculation with ease.

What is the Effective Interest Rate?

The effective interest rate, also known as the effective annual rate (EAR), is the actual rate of interest earned or paid on an investment or loan. It takes into account the effects of compounding, which can significantly impact the overall return or cost of borrowing.

Unlike the nominal interest rate, which represents the simple interest rate, the effective interest rate provides a more accurate representation of the time value of money. It allows investors and borrowers to compare different financial products and make informed choices.

Calculating Effective Interest Rate in Excel

Excel offers a range of functions and tools to simplify complex financial calculations, including the effective interest rate. Here's a step-by-step guide to help you compute the effective interest rate using Excel:

Step 1: Gather the Necessary Information

Before you begin, ensure you have the following information:

- Nominal interest rate (also known as the stated or annual percentage rate)

- Number of compounding periods per year

Step 2: Open Excel and Prepare Your Worksheet

- Launch Microsoft Excel on your computer.

- Create a new workbook or open an existing one where you want to perform the calculation.

- In your worksheet, create a dedicated section for the effective interest rate calculation. You can label it as "Effective Interest Rate Calculation" or something similar.

Step 3: Input the Nominal Interest Rate

In a cell, enter the nominal interest rate as a percentage. For example, if the nominal interest rate is 5%, you would enter 5% into the cell.

Step 4: Input the Number of Compounding Periods

In another cell, enter the number of compounding periods per year. This could be the number of times the interest is compounded annually. For example, if interest is compounded quarterly, you would enter 4 into the cell.

Step 5: Calculate the Effective Interest Rate

Excel provides a built-in function called EFFECT to calculate the effective interest rate. The syntax for the EFFECT function is as follows:

EFFECT(nominal_rate, npery)

Where:

nominal_rateis the nominal interest rate (the cell reference or value)nperyis the number of compounding periods per year (the cell reference or value)

In your worksheet, enter the following formula into a cell to calculate the effective interest rate:

=EFFECT(nominal_rate_cell_reference, compounding_periods_cell_reference)

For example, if you entered the nominal interest rate in cell A2 and the number of compounding periods in cell B2, your formula would be:

=EFFECT(A2, B2)

Press Enter, and Excel will display the effective interest rate in the cell.

Step 6: Format the Result

By default, Excel displays the result as a decimal value. To format it as a percentage, select the cell containing the effective interest rate, right-click, and choose Format Cells. In the Format Cells dialog box, select Percentage from the Number tab, and specify the desired number of decimal places. Click OK to apply the format.

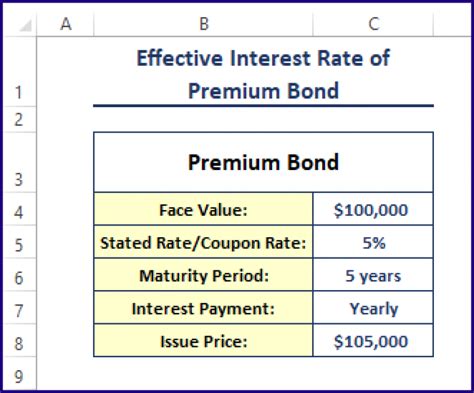

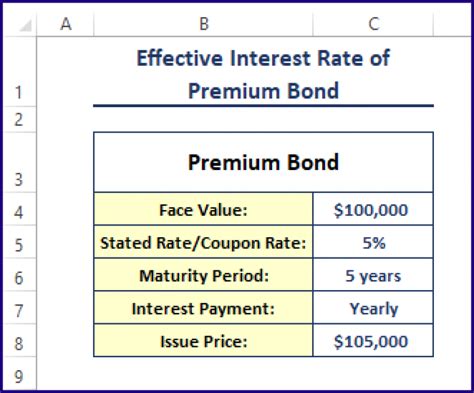

Example: Calculating Effective Interest Rate

Let's work through an example to calculate the effective interest rate for a loan with a nominal interest rate of 5% compounded quarterly.

- In cell

A1, enterNominal Interest Rateas a header. - In cell

A2, enter5%as the nominal interest rate. - In cell

B1, enterNumber of Compounding Periodsas a header. - In cell

B2, enter4as the number of compounding periods per year. - In cell

C1, enterEffective Interest Rateas a header. - In cell

C2, enter the formula=EFFECT(A2, B2)to calculate the effective interest rate. - Format cell

C2as a percentage with two decimal places.

The effective interest rate for this example would be 5.12%, indicating that the actual rate of interest earned or paid is higher than the nominal rate due to compounding.

Notes

💡 Note: The EFFECT function in Excel is particularly useful for calculating the effective interest rate when interest is compounded more than once a year. It takes into account the impact of compounding and provides a more accurate representation of the actual interest rate.

Conclusion

Computing the effective interest rate in Excel is a valuable skill for anyone dealing with investments, loans, or financial planning. By following the steps outlined in this guide, you can easily determine the actual rate of interest earned or paid, taking into account the effects of compounding. Excel's EFFECT function simplifies this calculation, allowing you to make more informed financial decisions. Remember to format your results as percentages for clarity and ease of interpretation.

Frequently Asked Questions

What is the difference between the nominal interest rate and the effective interest rate?

+

The nominal interest rate is the stated or simple interest rate, while the effective interest rate takes into account the effects of compounding. The effective interest rate provides a more accurate representation of the actual rate of interest earned or paid over a period.

Why is the effective interest rate important for financial decisions?

+

The effective interest rate helps investors and borrowers compare different financial products and understand the true cost or return of their investments or loans. It allows for a more accurate assessment of the time value of money and aids in making informed financial choices.

Can I use the EFFECT function for other financial calculations?

+

Yes, the EFFECT function is specifically designed for calculating the effective interest rate. However, Excel offers a wide range of financial functions that can be used for various calculations, such as PV for present value, FV for future value, and NPER for the number of periods.

What if I need to calculate the effective interest rate for monthly compounding?

+

If you need to calculate the effective interest rate for monthly compounding, simply adjust the number of compounding periods accordingly. For example, if interest is compounded monthly, use 12 as the number of compounding periods per year in the EFFECT function.

Are there any limitations to using the EFFECT function in Excel?

+The EFFECT function assumes that the compounding periods are evenly spaced throughout the year. If the compounding periods are not regular, you may need to use alternative methods or consider the time value of money principles to calculate the effective interest rate accurately.