Opening Paragraph

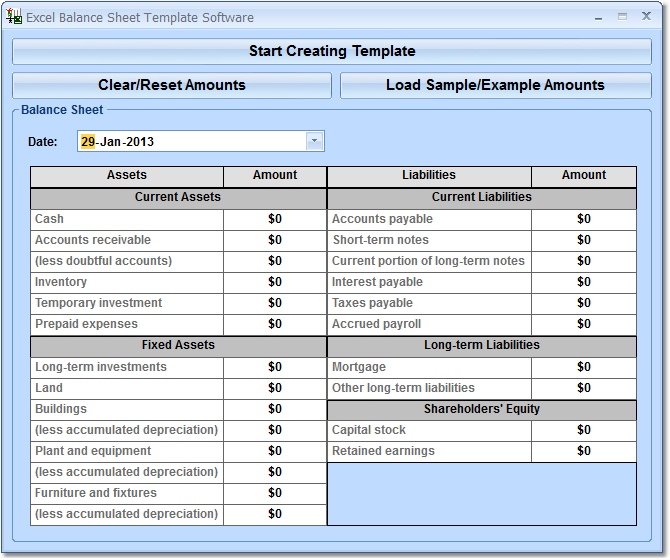

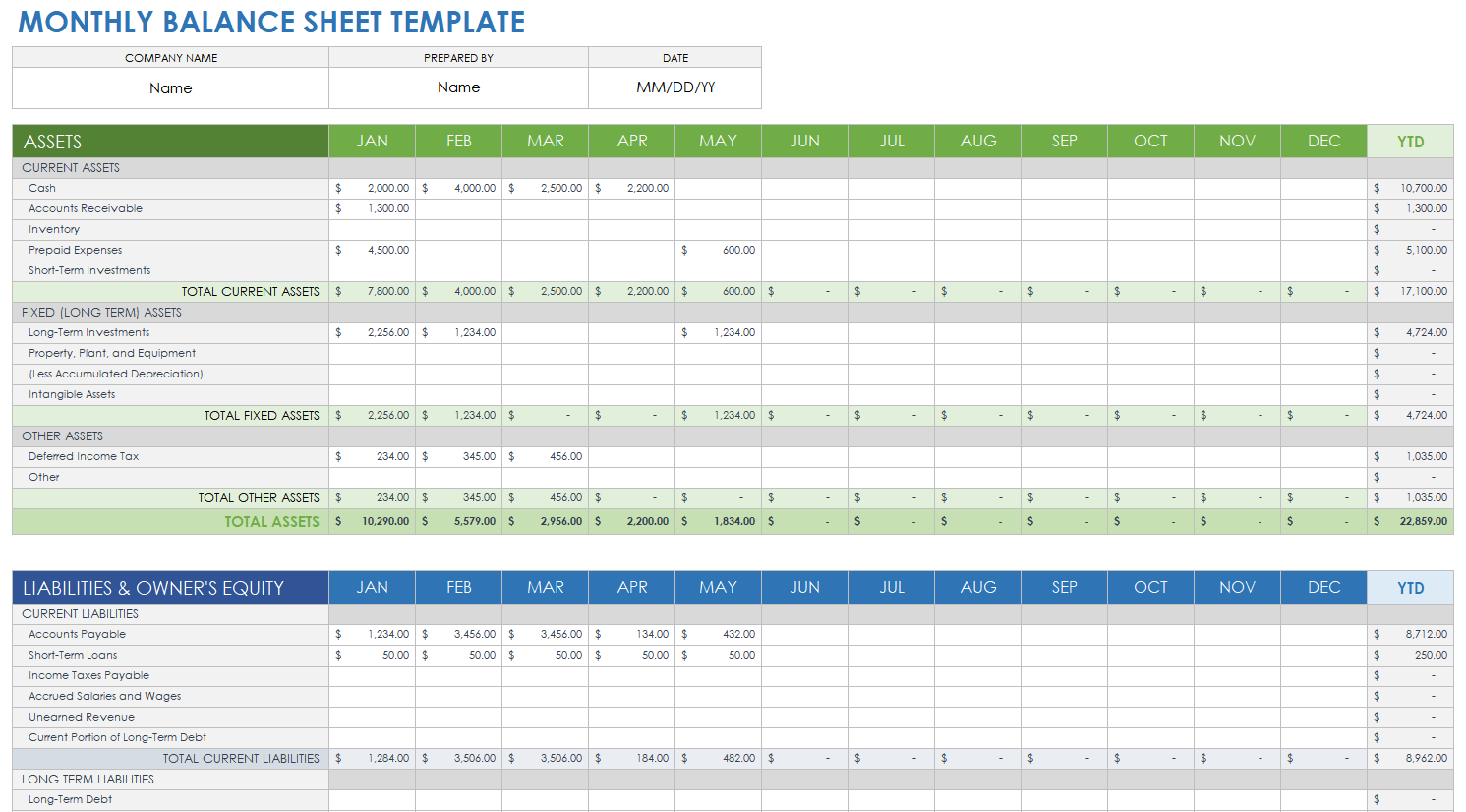

Creating a balance sheet in Excel is a straightforward process that can help you gain a clear financial overview of your business or personal finances. By following a few simple steps, you can generate a balance sheet that presents your assets, liabilities, and equity in a structured and organized manner. This guide will walk you through the process, ensuring you have a comprehensive understanding of how to create and interpret your balance sheet.

Understanding the Balance Sheet

A balance sheet is a crucial financial statement that provides a snapshot of an entity’s financial position at a specific point in time. It presents the organization’s assets, liabilities, and equity, offering valuable insights into its financial health and stability. Understanding how to construct and analyze a balance sheet is essential for business owners, investors, and financial analysts.

Gathering Data for Your Balance Sheet

Before diving into the creation of your balance sheet, you’ll need to gather the necessary financial data. This includes information on your assets, liabilities, and equity. Here’s a breakdown of what you’ll need:

Assets

- Current Assets: These are assets that can be easily converted into cash within a year. Examples include cash, accounts receivable, inventory, and marketable securities.

- Non-Current Assets: Also known as long-term assets, these are assets that are not easily convertible into cash and have a useful life of more than one year. Examples are property, plant, and equipment (PP&E), investments, and intangible assets like trademarks and patents.

Liabilities

- Current Liabilities: These are obligations that are due within a year. Examples include accounts payable, short-term loans, and accrued expenses.

- Non-Current Liabilities: Also referred to as long-term liabilities, these are obligations that are due after a year. Examples are long-term loans, bonds payable, and pension obligations.

Equity

- Owner’s Equity: This represents the owner’s stake in the business and is calculated by subtracting liabilities from assets. It includes capital contributions, retained earnings, and common stock.

- Shareholders’ Equity: This is relevant for corporations and includes common stock, preferred stock, retained earnings, and treasury stock.

Creating the Balance Sheet in Excel

Now that you have your data ready, it’s time to create your balance sheet in Excel. Follow these steps:

Step 1: Set Up the Worksheet

- Open a new Excel workbook and rename the default “Sheet1” to “Balance Sheet.”

- In the first row, create headers for “Account,” “Amount,” and “Description.”

- In the second row, start entering your asset accounts, such as “Cash,” “Accounts Receivable,” and “Inventory.”

- In the “Amount” column, enter the corresponding values for each asset.

- In the “Description” column, provide a brief explanation of each asset.

Step 2: Enter Asset Information

- Continue entering all your current and non-current asset accounts and their corresponding amounts and descriptions.

- Ensure that you maintain a consistent format throughout the worksheet.

Step 3: Calculate Total Assets

- In a new cell, typically below your last asset entry, create a label “Total Assets.”

- In the adjacent cell, use the SUM function to calculate the total value of your assets. For example:

=SUM(B2:B10)where B2:B10 represents the range of cells containing your asset amounts.

Step 4: Enter Liability Information

- Move to a new section of your worksheet, preferably below the assets section.

- Create headers for “Liability Account,” “Amount,” and “Description.”

- Start entering your current and non-current liability accounts, amounts, and descriptions.

Step 5: Calculate Total Liabilities

- Similar to calculating total assets, create a label “Total Liabilities” and use the SUM function to calculate the total value of your liabilities.

Step 6: Enter Equity Information

- Create a new section for equity, typically below the liabilities section.

- Set up headers for “Equity Account,” “Amount,” and “Description.”

- Enter the relevant equity accounts, amounts, and descriptions.

Step 7: Calculate Total Equity

- Calculate the total equity by summing up the amounts in the “Amount” column for your equity accounts.

Step 8: Verify the Balance

- Ensure that your balance sheet is balanced by checking if the total assets equal the sum of total liabilities and total equity.

- If the equation doesn’t balance, review your data and calculations for any errors.

Formatting and Presentation

Once you have created your balance sheet, consider the following formatting tips to enhance its readability and professionalism:

- Use Conditional Formatting: Apply conditional formatting to highlight positive and negative values, making it easier to identify areas of concern.

- Apply Borders and Shading: Use borders and shading to separate different sections of your balance sheet, such as assets, liabilities, and equity.

- Insert Formulas for Calculations: Instead of manually entering calculations, use Excel’s formula functionality to ensure accuracy and ease of updates.

- Insert Charts and Graphs: Visual representations like pie charts or bar graphs can provide a quick overview of your financial position.

Notes

📝 Note: When creating your balance sheet, ensure that you are using the most up-to-date financial information. Regularly update your balance sheet to reflect any changes in your financial position.

💡 Tip: Consider using Excel's built-in templates for financial statements. These templates can provide a solid starting point and save you time in formatting.

Conclusion

Creating a balance sheet in Excel is a valuable skill for anyone managing finances. By following the steps outlined in this guide, you can generate a clear and accurate representation of your financial position. Remember to regularly update your balance sheet to stay informed about your financial health and make informed decisions.

FAQ

What is the purpose of a balance sheet?

+A balance sheet provides a snapshot of an entity’s financial position at a specific point in time. It helps stakeholders assess the entity’s financial health, stability, and ability to meet its obligations.

How often should I update my balance sheet?

+It is recommended to update your balance sheet at least quarterly or whenever there are significant changes in your financial position. This ensures that you have an accurate and up-to-date view of your finances.

Can I create a balance sheet for personal finances in Excel?

+Absolutely! Excel is a versatile tool that can be used for both personal and business financial management. Creating a balance sheet for personal finances can help you track your assets, liabilities, and net worth.

How do I interpret the information on a balance sheet?

+A balance sheet provides insights into an entity’s financial health. It allows you to analyze the proportion of assets to liabilities, assess the liquidity of assets, and understand the sources of funding (liabilities and equity). By comparing balance sheets over time, you can track changes and identify trends.

What are some common ratios derived from a balance sheet?

+Common ratios derived from a balance sheet include the current ratio (current assets/current liabilities), quick ratio (quick assets/current liabilities), and debt-to-equity ratio (total liabilities/shareholders’ equity). These ratios provide insights into an entity’s liquidity, solvency, and financial leverage.