Calculating Annual Percentage Rate (APR) in Excel can be a powerful tool for financial analysis and decision-making. APR represents the yearly interest rate charged on loans or credit card balances, including any additional fees or costs. In this comprehensive guide, we will explore various methods to calculate APR in Excel, providing you with the skills to analyze and compare financial products effectively.

Understanding Annual Percentage Rate (APR)

Annual Percentage Rate (APR) is a crucial metric in the world of finance, especially when dealing with loans, mortgages, and credit cards. It provides a standardized way to compare the cost of borrowing money across different financial institutions and products. APR includes not only the interest rate but also any additional fees and charges, offering a more comprehensive view of the true cost of borrowing.

In simple terms, APR represents the yearly cost of borrowing, expressed as a percentage of the loan amount. It considers the interest rate and any other fees, such as origination fees, broker fees, or closing costs, making it a valuable tool for borrowers to assess the affordability and value of a loan or credit option.

Methods to Calculate APR in Excel

Excel offers several methods to calculate APR, catering to different loan structures and payment schedules. Here are some commonly used approaches:

Method 1: Using the RATE Function

The RATE function in Excel is a powerful tool for calculating the APR of a loan with regular periodic payments. It takes into account the loan amount, the number of payments, and the payment amount to determine the interest rate. The formula for the RATE function is as follows:

=RATE(nper, pmt, pv, [fv], [type], [guess])

Where:

- nper: The total number of payments for the loan.

- pmt: The payment made each period. It should be a negative value.

- pv: The present value, or the amount borrowed.

- fv: [Optional] The future value, or the balance after the last payment. Typically, this is set to 0.

- type: [Optional] Specifies when payments are due. 0 for the end of the period, 1 for the beginning. Default is 0.

- guess: [Optional] An estimate for the interest rate. If omitted, Excel uses 10%.

Example:

=RATE(36, -500, 10000)

This formula calculates the APR for a 3-year loan with monthly payments of $500, an initial loan amount of $10,000, and a 0% future value.

Method 2: Calculating APR with Amortization Schedules

For loans with irregular payments or additional fees, creating an amortization schedule in Excel can be beneficial. An amortization schedule breaks down each payment, showing the portion going towards interest and the portion reducing the principal. By analyzing this schedule, you can calculate the APR manually.

Steps to create an amortization schedule:

- Input loan details: Enter the loan amount, interest rate, term, and any additional fees.

- Calculate monthly interest: Use the formula

=PRINCIPAL * RATE, wherePRINCIPALis the remaining loan balance andRATEis the monthly interest rate. - Determine monthly payment: Use the

PMTfunction:=PMT(RATE, NPER, PV), whereRATEis the monthly interest rate,NPERis the number of payments, andPVis the present value (loan amount). - Calculate interest and principal for each payment: Subtract the interest from the monthly payment to find the principal reduction.

- Update the loan balance: Subtract the principal reduction from the previous balance.

- Repeat for each payment period.

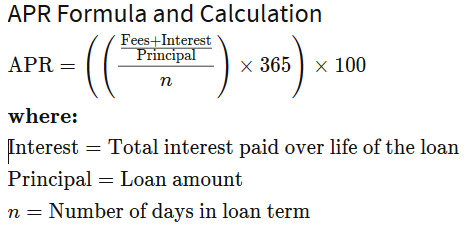

Once you have the amortization schedule, you can calculate the APR manually using the following formula:

APR = (Total Interest Paid / Total Loan Amount) * (Number of Payments per Year) * 100

Method 3: Utilizing Excel's Financial Functions

Excel's financial functions offer additional ways to calculate APR, especially for more complex loan structures. Some useful functions include:

- EFFECT: Calculates the effective annual interest rate, considering the effect of compounding.

- NOMINAL: Converts an annual percentage rate with a given number of compounding periods per year to an annual percentage rate with a different number of compounding periods.

- CUMIPMT: Returns the cumulative interest paid on a loan between a start period and an end period.

- CUMPRINC: Returns the cumulative principal paid on a loan between a start period and an end period.

These functions can be combined to calculate APR for various loan scenarios.

Comparing APR and APY

When dealing with financial products, it's essential to understand the difference between APR and APY (Annual Percentage Yield). APR represents the yearly interest rate, while APY includes the effect of compounding interest. APY provides a more accurate representation of the total cost of borrowing or the total return on an investment.

To calculate APY in Excel, you can use the following formula:

APY = (1 + (APR / n))^n - 1

Where n is the number of compounding periods per year.

Tips and Best Practices

- Always double-check your calculations and assumptions to ensure accuracy.

- Consider the loan term and payment schedule when choosing the appropriate APR calculation method.

- For complex loans, creating an amortization schedule can provide valuable insights into the loan's structure.

- Remember that APR and APY may differ, especially for loans with frequent compounding.

- Compare APR across different financial institutions to find the best deal.

Conclusion

Mastering APR calculations in Excel empowers you to make informed financial decisions. By understanding the different methods and considering the loan's characteristics, you can accurately assess the cost of borrowing and compare financial products. Whether you're taking out a loan or investing, Excel's APR calculation tools are invaluable for managing your finances effectively.

What is the difference between APR and APY?

+

APR represents the yearly interest rate, while APY includes the effect of compounding interest, providing a more accurate representation of the total cost of borrowing or return on investment.

Can I use Excel to calculate APR for loans with irregular payments?

+

Yes, by creating an amortization schedule in Excel, you can calculate APR for loans with irregular payments or additional fees.

Are there any limitations to using Excel for APR calculations?

+

Excel may not handle extremely complex loan structures with multiple variables and conditions. In such cases, specialized financial software might be more suitable.