Walmart, a leading retailer, offers its employees a convenient and efficient way to access their earnings information through Walmart Paystubs. These paystubs provide a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period. In this blog post, we will explore the key components of a Walmart Paystub, understand its importance, and guide you through the process of reading and interpreting it.

Understanding the Walmart Paystub

The Walmart Paystub serves as a vital document for employees, offering a transparent overview of their earnings and deductions. It contains crucial information that helps employees manage their finances effectively. Let's delve into the various sections of a typical Walmart Paystub and explore their significance.

Key Components of a Walmart Paystub

A Walmart Paystub typically consists of the following sections:

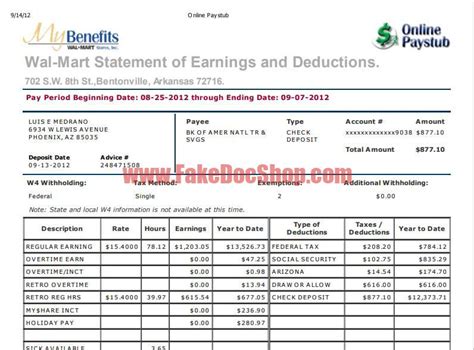

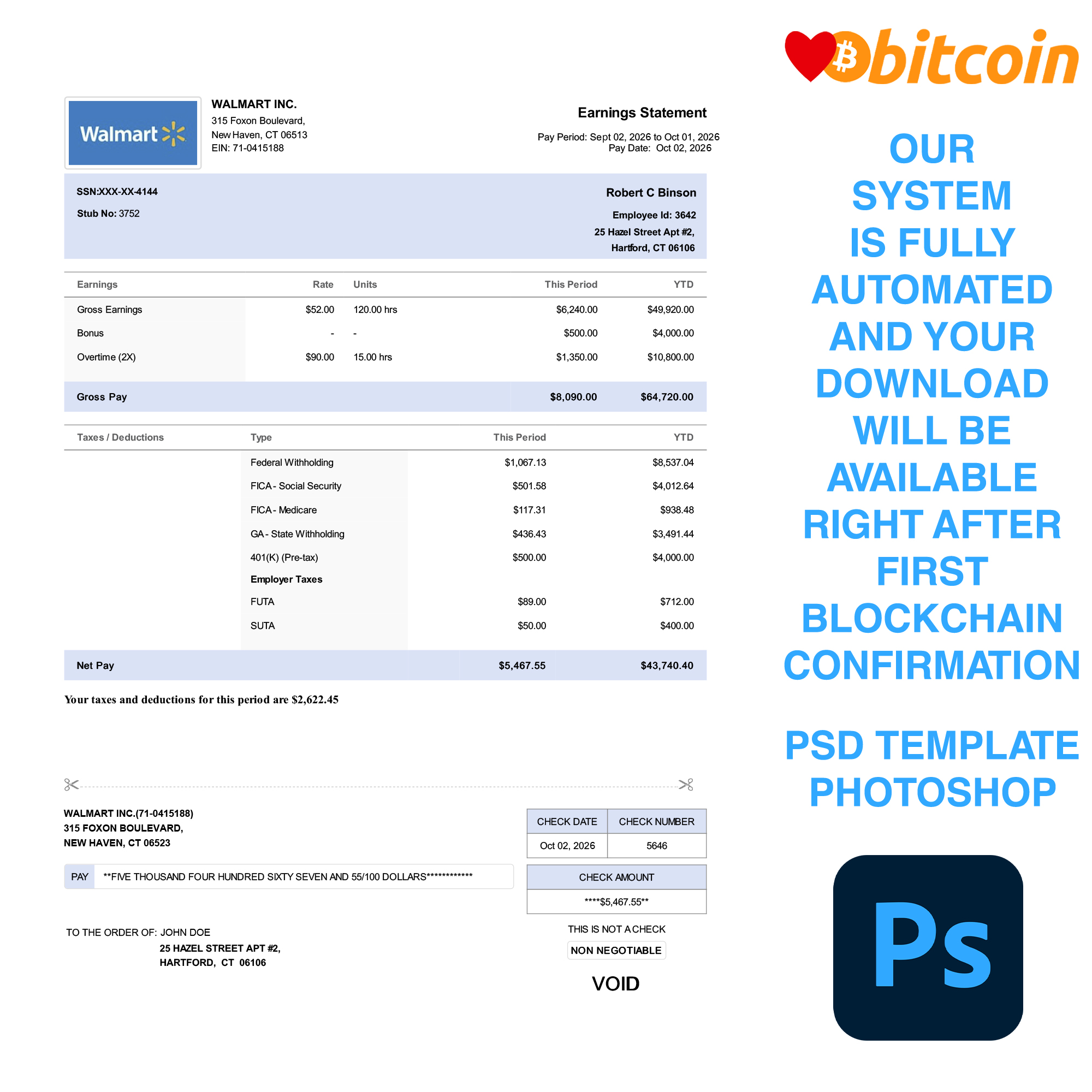

- Employee Information: This section displays essential details about the employee, including their name, employee ID, social security number, and department.

- Pay Period: The pay period indicates the specific dates for which the paystub covers. It usually spans two weeks, reflecting Walmart's bi-weekly payroll cycle.

- Earnings: Here, you'll find a breakdown of your earnings for the pay period. This includes your regular hourly rate, overtime pay (if applicable), bonuses, and any other additional earnings.

- Deductions: The deductions section outlines the various amounts withheld from your gross pay. These may include federal and state taxes, social security, Medicare, health insurance premiums, and any other voluntary deductions you've opted for, such as retirement contributions or charitable donations.

- Net Pay: The net pay, also known as take-home pay, is the amount you receive after all deductions have been applied. It represents the actual money you'll have in your bank account or on your paycheck.

- Year-to-Date (YTD) Summary: This section provides a summary of your earnings and deductions for the entire year. It offers a cumulative view of your income and deductions, helping you track your financial progress throughout the year.

Reading and Interpreting Your Paystub

Understanding your Walmart Paystub is essential for effective financial management. Here's a step-by-step guide to help you read and interpret your paystub accurately:

- Review Employee Information: Begin by verifying your personal details, such as your name, employee ID, and social security number. Ensure that the information is accurate and up-to-date.

- Check the Pay Period: Confirm the dates covered by the paystub. This ensures that you are receiving the correct pay for the specified period.

- Analyze Earnings: Review your earnings section to understand your base pay, overtime hours (if any), and any additional earnings. This information is crucial for budgeting and planning your finances.

- Understand Deductions: Carefully examine the deductions section. Familiarize yourself with the different types of deductions, such as taxes, insurance premiums, and any voluntary contributions. Understanding these deductions will help you calculate your net pay accurately.

- Calculate Net Pay: Determine your net pay by subtracting the total deductions from your gross pay. This amount represents the money you'll have available for personal use or savings.

- Review the YTD Summary: Take a look at the Year-to-Date summary to get an overview of your earnings and deductions for the entire year. This section can help you assess your financial progress and plan for the future.

Importance of Walmart Paystubs

Walmart Paystubs serve multiple purposes and offer several benefits to employees. Here are some key reasons why understanding and utilizing your paystub is important:

- Financial Management: Paystubs provide a clear picture of your earnings and deductions, enabling you to create a budget, track your expenses, and make informed financial decisions.

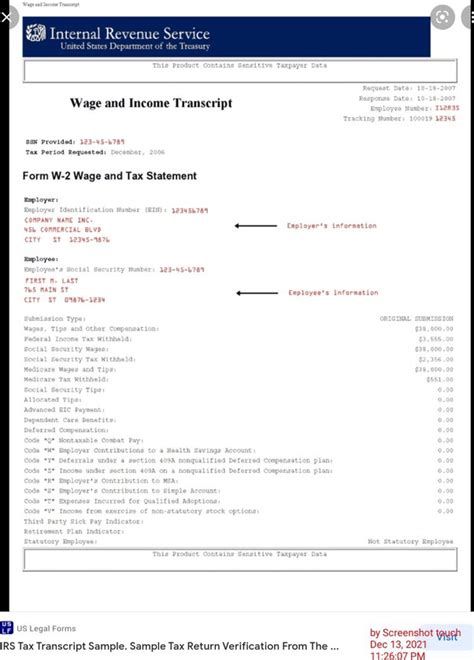

- Tax Preparation: The information on your paystub, such as income and tax deductions, is crucial for filing your tax returns accurately. It simplifies the tax preparation process and ensures compliance with tax regulations.

- Record-Keeping: Paystubs serve as official records of your earnings and deductions. They can be used as proof of income for various purposes, such as applying for loans, renting an apartment, or verifying employment.

- Identifying Errors: Regularly reviewing your paystub allows you to identify any errors or discrepancies in your earnings or deductions. If you notice any inaccuracies, you can promptly report them to the payroll department for resolution.

- Understanding Benefits: Paystubs often include information about your employee benefits, such as health insurance coverage, retirement plans, or other perks. By reviewing this section, you can better understand the value of your benefits package and make informed decisions about your financial well-being.

Tips for Maximizing Your Paystub

To make the most of your Walmart Paystub, consider the following tips:

- Keep Digital Copies: Save digital copies of your paystubs in a secure location, such as a cloud storage service or a dedicated folder on your computer. This ensures easy access to your paystub history and provides a backup in case of any issues.

- Review Regularly: Make it a habit to review your paystub with each new pay period. This helps you stay informed about any changes in your earnings, deductions, or benefits. Regular reviews also allow you to identify any potential errors or discrepancies early on.

- Use for Budgeting: Utilize your paystub as a tool for budgeting. By understanding your net pay and expenses, you can create a realistic budget that aligns with your financial goals and priorities.

- Seek Clarification: If you have any questions or concerns about your paystub, don't hesitate to reach out to the payroll department or your supervisor. They can provide further clarification and address any issues you may have.

- Stay Informed about Benefits: Take the time to read and understand the benefits section of your paystub. Stay updated on any changes or additions to your benefits package, as this information can impact your overall financial well-being.

Conclusion

Walmart Paystubs are valuable resources that provide employees with essential information about their earnings and deductions. By understanding the key components of your paystub and regularly reviewing it, you can effectively manage your finances, prepare for tax obligations, and make informed decisions about your financial future. Remember to keep digital copies, review your paystub regularly, and utilize it as a tool for budgeting and financial planning. With a clear understanding of your paystub, you can take control of your financial journey and make the most of your earnings.

How often do Walmart employees receive paystubs?

+

Walmart employees typically receive paystubs on a bi-weekly basis, reflecting the company’s payroll cycle.

Can I access my paystub online?

+

Yes, Walmart offers an online portal where employees can access their paystubs digitally. This portal provides a convenient way to view and download paystub information.

What should I do if I notice an error on my paystub?

+

If you identify any errors or discrepancies on your paystub, contact the payroll department or your supervisor immediately. They can assist in resolving the issue and ensuring accurate pay information.

How can I use my paystub as proof of income?

+

Your paystub can be used as proof of income for various purposes, such as applying for loans or verifying employment. Simply provide a copy of your paystub when requested, ensuring it contains the necessary information, such as your name, earnings, and deductions.

Can I request a paper copy of my paystub?

+

Yes, Walmart employees can request paper copies of their paystubs. Contact the payroll department or refer to the company’s policies to learn more about obtaining a physical copy.