Excel, the versatile spreadsheet software, is a powerful tool for financial analysis and calculations. In this guide, we will explore the process of creating an interest rate calculator in Excel, a valuable tool for anyone dealing with loans, investments, or simple interest calculations. By following these steps, you can enhance your financial management skills and gain a deeper understanding of interest rates.

Step 1: Understanding the Basics of Interest Rates

Before diving into the creation of an interest rate calculator, it's essential to grasp the fundamental concepts of interest rates. Interest rates are the cost of borrowing money or the return on invested capital. They are expressed as a percentage and can be calculated using various formulas, depending on the type of interest involved.

There are two primary types of interest:

- Simple Interest: This is calculated only on the principal amount, and the interest remains the same throughout the loan or investment period.

- Compound Interest: Here, interest is calculated on the initial principal amount and any accumulated interest from previous periods. It results in a higher total interest over time.

Step 2: Gathering Necessary Data

To build an effective interest rate calculator, you'll need to collect relevant data. This data will serve as inputs for your calculator and help in generating accurate results.

- Principal Amount: The initial amount borrowed or invested.

- Interest Rate: The percentage rate at which interest is calculated.

- Time Period: The duration for which the interest is applied, typically in years or months.

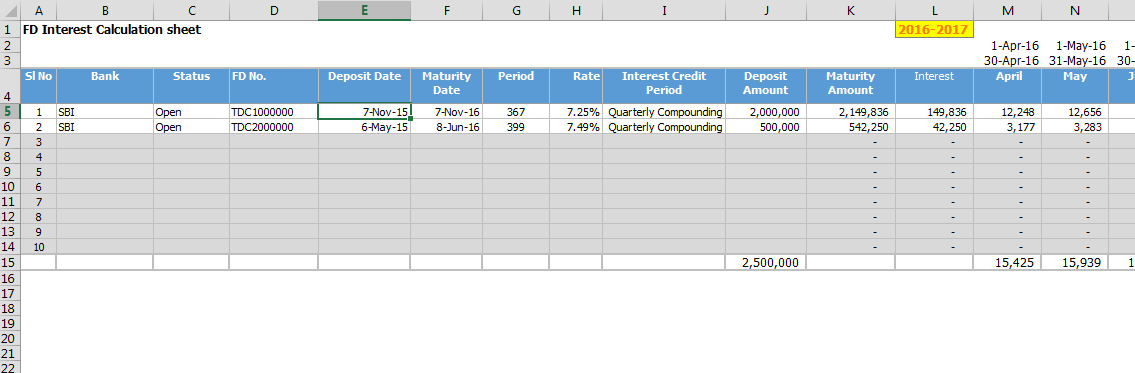

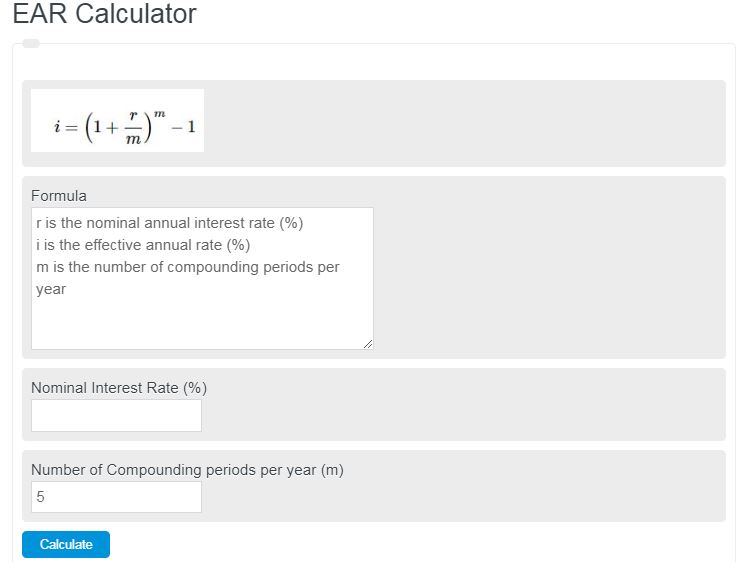

- Compounding Frequency: For compound interest, this represents how often interest is compounded (e.g., annually, semi-annually, quarterly, monthly, etc.).

Step 3: Setting Up the Excel Worksheet

Now, let's create a structured Excel worksheet to house our interest rate calculator.

Worksheet Design

Start by creating a new Excel workbook and renaming the first sheet as "Interest Calculator."

In the first row, create headers for the data you'll be inputting and calculating. For instance:

- Principal Amount

- Interest Rate

- Time Period

- Compounding Frequency

- Simple Interest

- Compound Interest

Leave the first column blank for data input. In the second column, you can insert formulas to calculate the respective values.

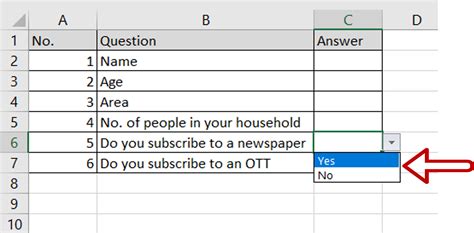

Inputting Data

In the first column, input the values for the principal amount, interest rate, time period, and compounding frequency. Ensure that you format the interest rate and time period cells as percentages and the compounding frequency cell as a number.

Step 4: Creating Formulas for Interest Calculation

Now, it's time to insert the formulas that will perform the interest calculations. These formulas will be placed in the respective cells next to the data input cells.

Simple Interest Formula

The formula for simple interest is:

= Principal Amount * Interest Rate * Time Period

Enter this formula in the "Simple Interest" cell.

Compound Interest Formula

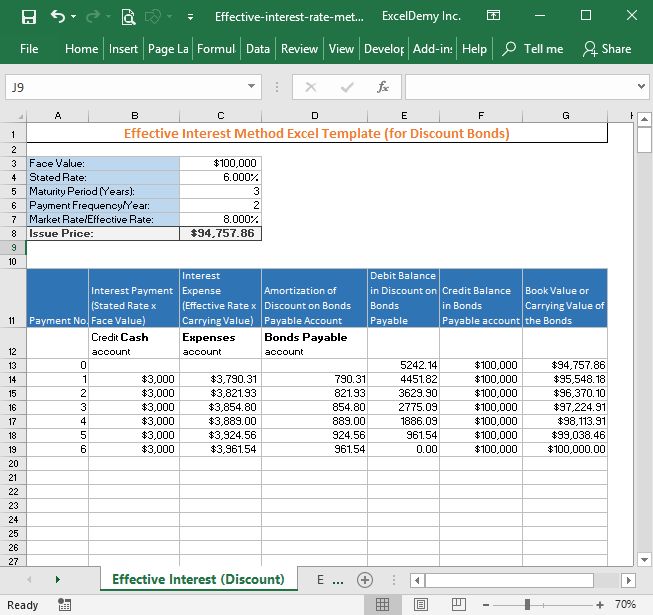

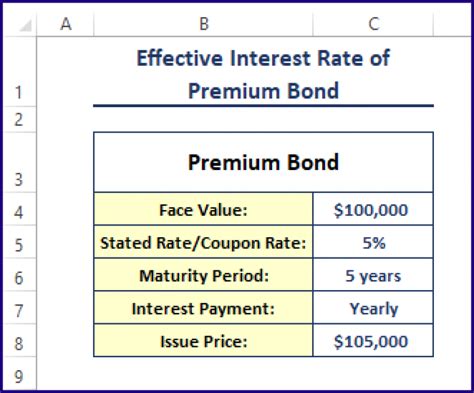

The formula for compound interest is:

= Principal Amount * (1 + (Interest Rate / Compounding Frequency)) ^ (Compounding Frequency * Time Period) - Principal Amount

Enter this formula in the "Compound Interest" cell.

Step 5: Testing and Formatting

With the formulas in place, it's time to test your interest rate calculator. Input different values for the principal amount, interest rate, time period, and compounding frequency to ensure accurate calculations.

Once you've verified the calculator's accuracy, consider formatting the cells to enhance readability. You can use Excel's formatting tools to apply number formats, colors, and borders to make the calculator more user-friendly.

Conclusion

Creating an interest rate calculator in Excel is a valuable skill for anyone dealing with financial calculations. By following these steps, you've learned to set up a structured worksheet, input data, and apply formulas to calculate simple and compound interest. This tool can be a powerful asset for managing loans, investments, and financial planning.

Remember, practice makes perfect. Experiment with different scenarios and share your interest rate calculator with colleagues or friends who may find it useful. Keep refining your skills, and you'll become an Excel pro in no time!

FAQ

Can I customize the calculator for specific currencies or regions?

+

Absolutely! You can modify the calculator to work with different currencies by adjusting the interest rate and time period formats. Simply ensure that you use the appropriate currency symbol and format for your chosen currency.

How can I make the calculator more user-friendly?

+

Consider adding data validation to ensure that users enter valid inputs. You can also create a user-friendly interface by using Excel’s conditional formatting and input masks to guide users in entering data.

Is it possible to automate the calculator to update interest rates automatically?

+

Yes, you can link your calculator to external data sources like financial websites or APIs. This way, you can fetch the latest interest rates and update your calculator automatically. However, this requires advanced Excel skills and some programming knowledge.

Can I create a more advanced calculator with additional features?

+

Absolutely! You can expand your calculator by adding features like amortization schedules, loan repayment calculators, or even investment growth projections. The possibilities are endless, and Excel’s flexibility allows for creative financial modeling.

How do I share my interest rate calculator with others?

+

You can share your calculator by saving your Excel workbook as a template (.xltx) or a macro-enabled workbook (.xlsm). This way, others can easily open and use your calculator without making any changes to the original file.