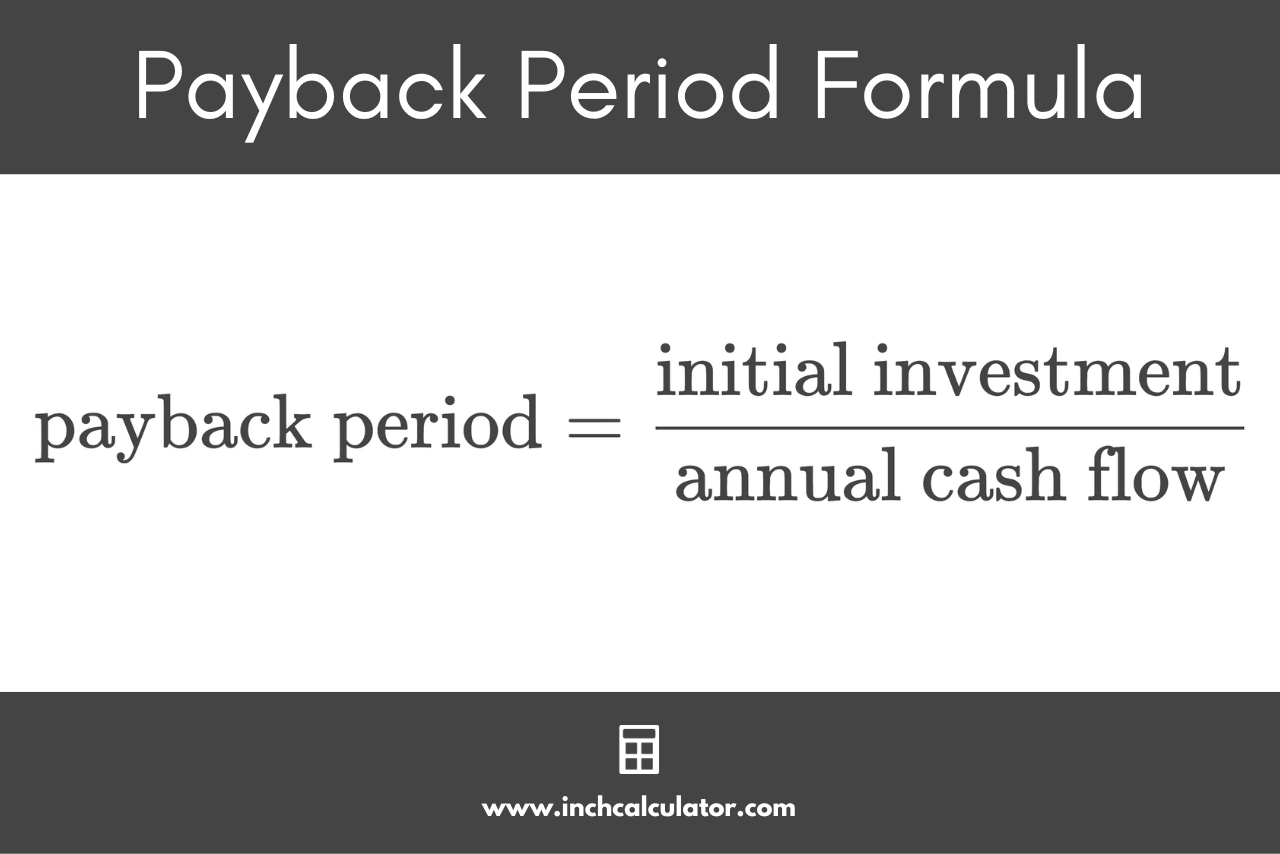

Payback period analysis is a crucial aspect of financial planning and investment evaluation. It provides valuable insights into the time required for an investment to recover its initial cost. In this comprehensive guide, we will explore six methods to calculate the payback period in Excel, empowering you to make informed financial decisions.

Method 1: Manual Calculation

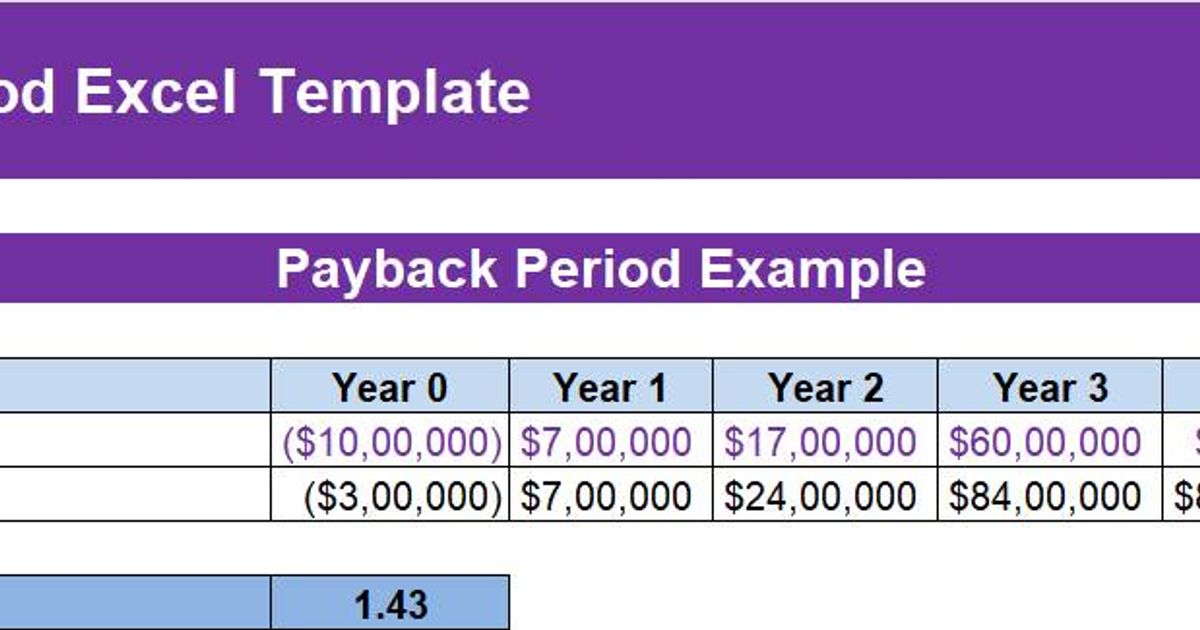

The simplest way to determine the payback period is through manual calculation. This method involves identifying the year in which the cumulative cash flows equal or exceed the initial investment. Let's illustrate this with an example.

Suppose you invest $10,000 in a project with the following annual cash flows:

- Year 1: $3,000

- Year 2: $4,000

- Year 3: $5,000

To find the payback period:

- Calculate the cumulative cash flows for each year.

- Identify the year when the cumulative cash flows reach or surpass the initial investment.

In this case, the payback period is 2.5 years as the cumulative cash flows exceed $10,000 by the end of the second year.

Method 2: Formulas in Excel

Excel offers a range of formulas to streamline the calculation of the payback period. One commonly used formula is the PMT function, which calculates the payment for a loan based on constant payments and a constant interest rate.

Here's an example of how to use the PMT function to find the payback period:

- Input the annual cash flows and the initial investment in Excel.

- Use the

PMTfunction to calculate the payback period. - The formula is as follows:

=PMT(rate, nper, pv) - Where

rateis the discount rate,nperis the number of periods, andpvis the present value (initial investment). - Adjust the formula to account for the appropriate cash flows and discount rate.

The PMT function will provide the annual payment required to recover the initial investment within the specified number of periods.

Method 3: Excel's IRR Function

The IRR (Internal Rate of Return) function in Excel is a powerful tool for calculating the payback period. It determines the discount rate at which the net present value of an investment is zero. By using the IRR function, you can find the point at which the cumulative cash flows equal the initial investment.

- Input the annual cash flows and the initial investment in Excel.

- Use the

IRRfunction to calculate the internal rate of return. - The formula is as follows:

=IRR(values, guess) - Where

valuesrepresent the array of cash flows, andguessis an optional argument for the initial guess of the internal rate of return. - Once you have the IRR, you can determine the payback period.

Method 4: Custom Payback Period Formula

If you prefer a more customized approach, you can create your own formula to calculate the payback period. This method allows you to incorporate specific assumptions and considerations into your calculations.

- Define the necessary variables and assumptions for your analysis.

- Create a formula that calculates the cumulative cash flows for each year.

- Identify the year when the cumulative cash flows equal or exceed the initial investment.

- Adjust the formula as needed to account for varying cash flows or other factors.

Here's an example formula:

Payback Period = MIN(YEAR(CUMIPMT(rate, years, pv, pmt, fv, type)))

Where rate is the discount rate, years is the number of years, pv is the present value, pmt is the annual payment, fv is the future value, and type specifies the timing of cash flows.

Method 5: Excel's XIRR Function

The XIRR (Extended Internal Rate of Return) function in Excel is similar to the IRR function but allows for non-periodic cash flows. It is particularly useful when cash flows occur at irregular intervals.

- Input the dates and corresponding cash flows in Excel.

- Use the

XIRRfunction to calculate the extended internal rate of return. - The formula is as follows:

=XIRR(values, dates, guess) - Where

valuesrepresent the array of cash flows,datesare the corresponding dates, andguessis an optional argument for the initial guess of the internal rate of return. - The

XIRRfunction will provide the internal rate of return, which can be used to determine the payback period.

Method 6: Visualizing Payback Period with Charts

To enhance your analysis and better understand the payback period, you can create visual representations using charts in Excel.

- Input the annual cash flows and the initial investment in Excel.

- Create a chart, such as a line chart or an area chart, to visualize the cumulative cash flows over time.

- Add a reference line or marker to indicate the initial investment amount.

- By observing the intersection of the cumulative cash flow line and the reference line, you can determine the payback period.

🌟 Note: Visualizing the payback period with charts provides a clear visual representation of when the investment reaches the break-even point.

Conclusion

Computing the payback period in Excel is a valuable skill for financial analysis and decision-making. By utilizing the methods outlined in this guide, you can efficiently evaluate the time required for an investment to recover its initial cost. Whether through manual calculation, Excel formulas, or visual representations, understanding the payback period empowers you to make informed choices and assess the potential returns of your investments.

What is the payback period, and why is it important in financial analysis?

+

The payback period refers to the time it takes for an investment to recover its initial cost. It is important in financial analysis as it provides a quick assessment of an investment’s liquidity and risk. A shorter payback period indicates a faster return on investment and reduced financial risk.

Can I use Excel’s goal seek feature to find the payback period?

+

Yes, Excel’s goal seek feature can be utilized to find the payback period. By setting the initial investment as the goal and adjusting the annual payment or discount rate, you can determine the year when the cumulative cash flows equal the initial investment.

How do I handle negative cash flows in the payback period calculation?

+

Negative cash flows can be accounted for by adjusting the cash flow values or using appropriate formulas. Ensure that you consider the timing and magnitude of negative cash flows to accurately calculate the payback period.

Are there any limitations to the payback period analysis?

+

The payback period analysis has limitations, as it does not consider the time value of money or the potential for future cash flows beyond the payback period. It is recommended to use other financial metrics, such as net present value or internal rate of return, for a more comprehensive evaluation.