Arizona’s Minimum Wage: A Comprehensive Guide

Arizona’s minimum wage laws are an important aspect of the state’s employment landscape, ensuring fair compensation for workers. In this guide, we will delve into the intricacies of Arizona’s minimum wage, covering the current rates, how they are determined, and the impact they have on businesses and employees. By understanding these laws, both employers and employees can navigate the legal framework and ensure compliance.

Understanding the Basics

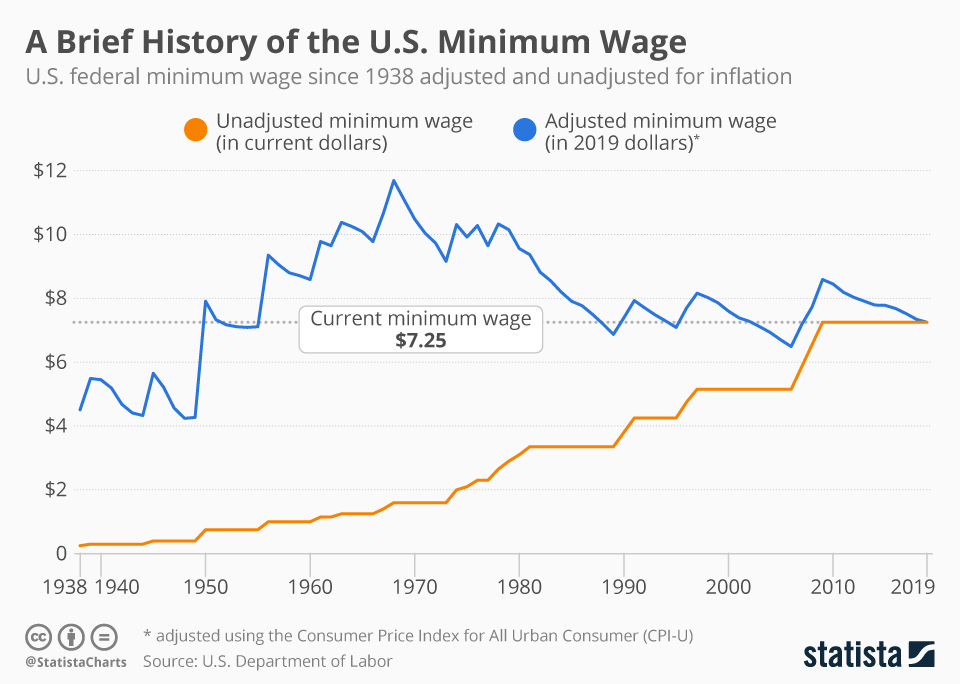

Arizona has its own minimum wage laws, separate from the federal minimum wage. The state’s minimum wage rate is determined by a combination of factors, including inflation adjustments and voter-approved initiatives. It is essential to stay updated on the latest wage rates to ensure compliance with the law.

The minimum wage in Arizona is not a one-size-fits-all approach. It varies depending on various factors, such as the number of employees a business has and the type of industry it operates in. This differentiation aims to strike a balance between providing a fair wage and supporting the economic growth of different sectors.

Current Minimum Wage Rates

As of [Insert Current Year], the minimum wage in Arizona is [Insert Current Rate] per hour. However, it is important to note that this rate is subject to change annually, typically based on the Consumer Price Index (CPI) adjustments.

Here is a breakdown of the current minimum wage rates in Arizona:

- Standard Minimum Wage: [Insert Standard Rate] per hour for most employees.

- Employer Size Minimum Wage: [Insert Rate for Small Businesses] per hour for businesses with fewer than [Insert Number] employees.

- Tipped Employee Minimum Wage: [Insert Tipped Rate] per hour for employees who receive tips, with the expectation that tips will make up the difference to reach the standard minimum wage.

It is crucial for employers to ensure that they are paying their employees the correct wage based on their specific circumstances.

Determining Minimum Wage

The process of determining Arizona’s minimum wage involves a combination of legislative actions and economic considerations. The Arizona Minimum Wage Commission plays a vital role in setting the wage rates. This commission takes into account factors such as the cost of living, inflation, and the state’s economic climate when making adjustments.

| Year | Minimum Wage |

|---|---|

| 2022 | $12.80 |

| 2021 | $12.15 |

| 2020 | $12.15 |

| 2019 | $11.00 |

Additionally, voter-approved initiatives, such as Proposition 206, have had a significant impact on Arizona’s minimum wage. These initiatives often aim to gradually increase the minimum wage over a set period, ensuring a steady rise in wages.

Impact on Businesses and Employees

Arizona’s minimum wage laws have both positive and challenging implications for businesses and employees. On one hand, a higher minimum wage can lead to increased consumer spending, as employees have more disposable income. This, in turn, can boost the local economy and create a more prosperous business environment.

However, businesses, especially small businesses, may face challenges in adjusting to the increased wage rates. They might need to reevaluate their operational costs, pricing strategies, and staffing levels to accommodate the higher wage expenses.

For employees, a higher minimum wage means improved financial stability and the ability to meet basic needs. It can also encourage job seekers to explore opportunities within the state, as Arizona becomes a more attractive employment destination.

Compliance and Enforcement

Compliance with Arizona’s minimum wage laws is crucial to avoid legal consequences. The Arizona Department of Labor provides resources and guidance to help employers understand their obligations. They offer educational materials, webinars, and even conduct on-site visits to ensure businesses are adhering to the wage requirements.

In the event of non-compliance, the department has the authority to investigate and take appropriate enforcement actions. This may include imposing fines, requiring back wages to be paid, or even seeking legal action against the employer.

Notes on Minimum Wage Exemptions

It is important to note that certain categories of employees are exempt from Arizona’s minimum wage laws. These exemptions include:

- Apprentices and Trainees: Individuals participating in approved apprenticeship or training programs may be paid a lower wage as part of their training.

- Tipped Employees: As mentioned earlier, tipped employees have a lower minimum wage rate, but their total earnings, including tips, must meet or exceed the standard minimum wage.

- Full-Time Students: Students working part-time jobs in certain industries may be eligible for a lower minimum wage rate.

Employers should carefully review the specific criteria and guidelines for these exemptions to ensure they are applied correctly.

Conclusion

Arizona’s minimum wage laws provide a framework for fair compensation, aiming to support both businesses and employees. By understanding the current rates, the determination process, and the impact on various stakeholders, employers and employees can navigate the legal landscape effectively. Stay informed, comply with the regulations, and contribute to a thriving Arizona economy.

FAQ

What happens if an employer doesn’t pay the minimum wage in Arizona?

+

Employers who fail to pay the minimum wage may face legal consequences. The Arizona Department of Labor can investigate such cases, impose fines, and require the employer to pay back wages to affected employees.

Are there any plans to increase the minimum wage in the future?

+

The minimum wage in Arizona is subject to annual adjustments based on inflation. Additionally, there may be ongoing discussions and proposals to further increase the minimum wage through legislative actions or voter initiatives.

Can employers offer benefits instead of paying the minimum wage?

+No, employers cannot substitute benefits for the minimum wage. The minimum wage is a legal requirement, and employers must comply with it regardless of the benefits they offer.