Indiana's minimum wage regulations are a topic of interest, especially when it comes to understanding the current rates, the history of changes, and the impact on workers and businesses. This comprehensive guide aims to shed light on the secrets behind Indiana's ultimate minimum wage, providing you with all the information you need to stay informed.

Understanding Indiana's Minimum Wage Landscape

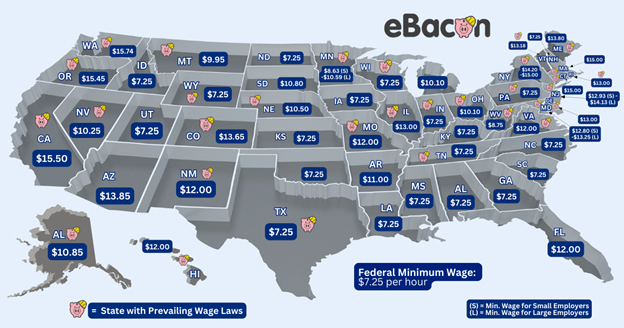

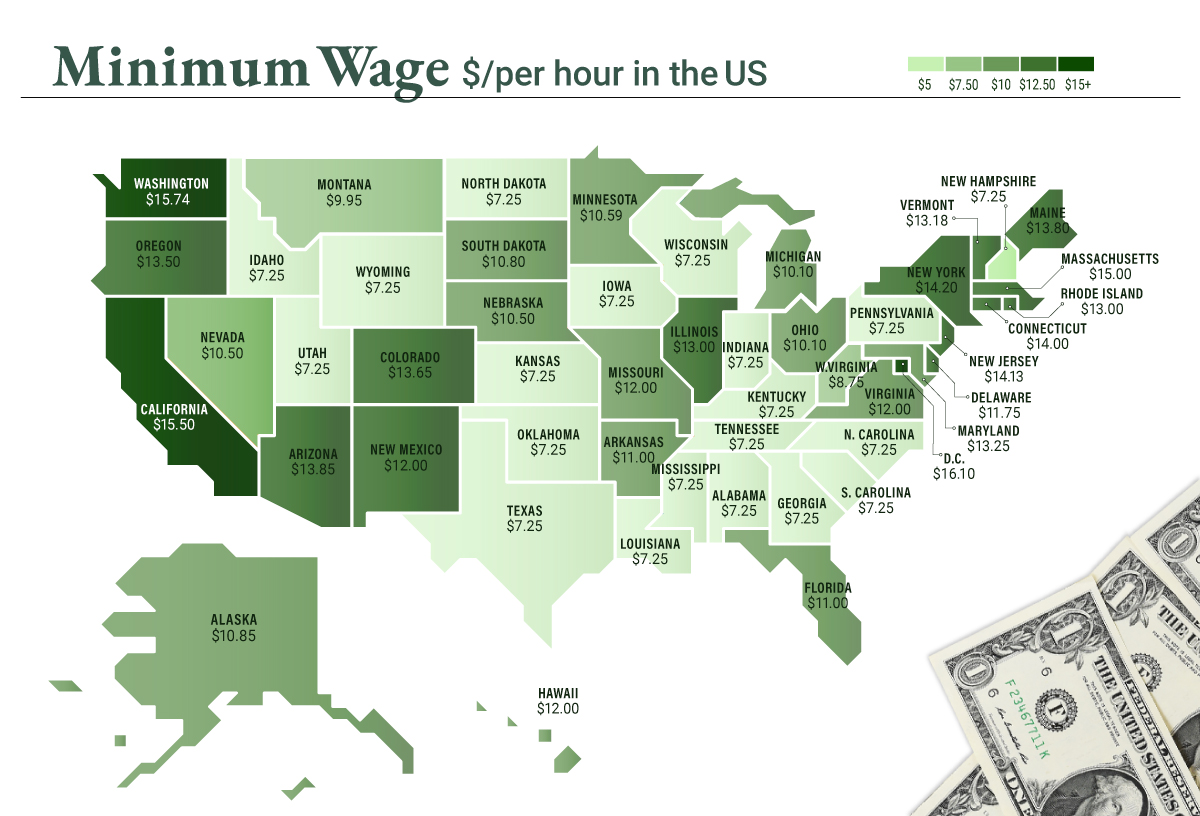

Indiana, like many other states, has its own set of minimum wage laws that differ from the federal minimum wage. The state's minimum wage rate is an important factor in determining the earning potential of workers and the overall economic landscape.

Current Minimum Wage Rate

As of my last update in January 2023, the current minimum wage in Indiana is $7.25 per hour. This rate applies to all employees, regardless of their age or occupation, unless they are subject to specific exemptions.

Historical Changes

Indiana's minimum wage has undergone several adjustments over the years. Here's a brief overview of the key changes:

- 2006: The minimum wage was raised to $5.15 per hour, which was the federal minimum at the time.

- 2007: Indiana adopted a higher minimum wage of $6.15 per hour, exceeding the federal rate.

- 2008: Another increase was implemented, setting the minimum wage at $7.25 per hour, which has remained unchanged since.

Exemptions and Special Cases

It's important to note that certain categories of workers may be exempt from the minimum wage requirements. These include:

- Tipped employees: These workers can be paid a lower base wage, provided they earn enough in tips to meet the minimum wage threshold.

- Minors: Employees under the age of 20 can be paid a training wage of $4.25 per hour for the first 90 days of employment.

- Full-time students: Students working part-time jobs on school grounds may be eligible for a lower minimum wage rate.

The Impact of Minimum Wage on Indiana's Economy

The minimum wage plays a crucial role in shaping Indiana's economic landscape and has both positive and negative effects on various stakeholders.

Benefits for Workers

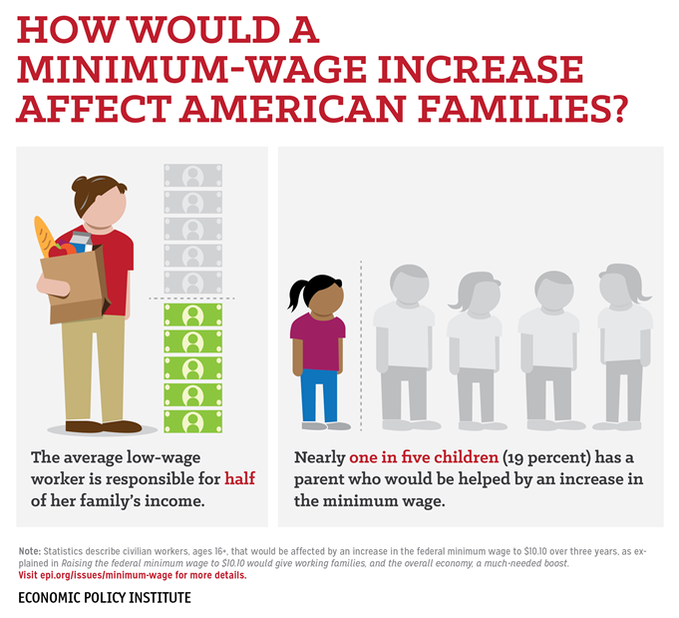

- Increased Purchasing Power: A higher minimum wage allows workers to afford basic necessities and improve their standard of living.

- Reduced Income Inequality: By setting a fair wage floor, the minimum wage helps bridge the gap between high- and low-income earners.

- Improved Employee Retention: Higher wages can lead to increased job satisfaction and reduced turnover rates.

Challenges for Businesses

- Increased Labor Costs: Raising the minimum wage can result in higher payroll expenses for businesses, especially small and medium-sized enterprises.

- Potential Job Losses: Some argue that an increased minimum wage may lead to job cuts or reduced hiring, particularly in industries with tight profit margins.

- Impact on Business Operations: Businesses may need to adjust their pricing strategies or find ways to increase efficiency to accommodate higher labor costs.

Minimum Wage Enforcement and Compliance

Ensuring compliance with minimum wage laws is crucial to protect workers' rights and maintain a fair workplace. Indiana has implemented measures to enforce these regulations effectively.

Role of the Indiana Department of Labor

The Indiana Department of Labor is responsible for enforcing minimum wage laws and investigating complaints related to wage violations. They have the authority to conduct audits, inspect payroll records, and take legal action against non-compliant employers.

Reporting Wage Violations

If you believe your employer is not complying with minimum wage laws, you have the right to report it. The Indiana Department of Labor provides a confidential process for filing complaints. You can reach out to their Wage Claim Division for assistance and guidance.

Penalties for Non-Compliance

Employers found guilty of violating minimum wage laws may face penalties, including:

- Fines and penalties

- Back wages owed to employees

- Potential legal consequences

Minimum Wage and the Future of Work in Indiana

The discussion around minimum wage is an ongoing dialogue, with debates surrounding potential increases and the impact on the future of work in Indiana.

Proposed Increases

There have been proposals to raise Indiana's minimum wage to match or exceed the federal rate. These proposals aim to address concerns about the rising cost of living and the need for a living wage.

Potential Benefits of an Increased Minimum Wage

- Improved Living Standards: A higher minimum wage can help workers afford essential goods and services, reducing financial strain.

- Boost to the Local Economy: Increased consumer spending can stimulate local businesses and create a positive economic cycle.

- Attracting and Retaining Talent: A competitive minimum wage may make Indiana more attractive to skilled workers, contributing to a stronger workforce.

Tips for Employers and Employees

Both employers and employees have a role to play in ensuring fair and compliant minimum wage practices.

Advice for Employers

- Stay Informed: Keep up-to-date with the latest minimum wage laws and regulations to ensure compliance.

- Accurate Record-Keeping: Maintain accurate payroll records to demonstrate compliance during audits.

- Offer Competitive Wages: Consider offering wages above the minimum to attract and retain top talent.

Advice for Employees

- Know Your Rights: Familiarize yourself with Indiana's minimum wage laws and your rights as an employee.

- Speak Up: If you believe your rights are being violated, don't hesitate to report it to the appropriate authorities.

- Negotiate: In some cases, you may have the opportunity to negotiate wages, especially if you bring valuable skills or experience to the table.

Frequently Asked Questions (FAQ)

What is the current minimum wage in Indiana as of 2023?

+The current minimum wage in Indiana is $7.25 per hour as of my last update in January 2023.

Are there any exceptions to the minimum wage in Indiana?

+Yes, certain categories of workers, such as tipped employees and minors, may be subject to different wage rates.

How can I report a minimum wage violation in Indiana?

+You can contact the Indiana Department of Labor's Wage Claim Division to report a minimum wage violation. They offer a confidential process for filing complaints.

What are the potential consequences for employers who violate minimum wage laws?

+Employers found guilty of violating minimum wage laws may face fines, penalties, and legal consequences. They may also be required to pay back wages to affected employees.

Are there any proposed changes to Indiana's minimum wage in the near future?

+Proposals to increase Indiana's minimum wage to match or exceed the federal rate have been discussed, but as of my knowledge cutoff in January 2023, there are no confirmed changes.

Final Thoughts

Indiana's minimum wage regulations are a critical aspect of the state's economic framework, impacting both workers and businesses. By understanding the current rates, historical changes, and the potential future of minimum wage, we can better navigate the complex landscape of labor laws. Whether you're an employer, employee, or simply interested in Indiana's economic affairs, staying informed about minimum wage secrets is essential.

Remember to stay updated with the latest developments and always prioritize fair and compliant practices to ensure a thriving and equitable workforce.