The payback period is a financial metric that measures the time it takes to recoup an investment. It is a simple yet powerful tool for evaluating the attractiveness of potential projects or investments. In this blog post, we will delve into the Excel Payback Formula, providing you with a comprehensive guide to calculate and interpret the payback period effectively.

Understanding the Payback Period

The payback period is an essential concept in finance and investment analysis. It helps businesses and investors make informed decisions by assessing the time required to recover the initial investment. By calculating the payback period, you can compare different investment opportunities and determine their viability.

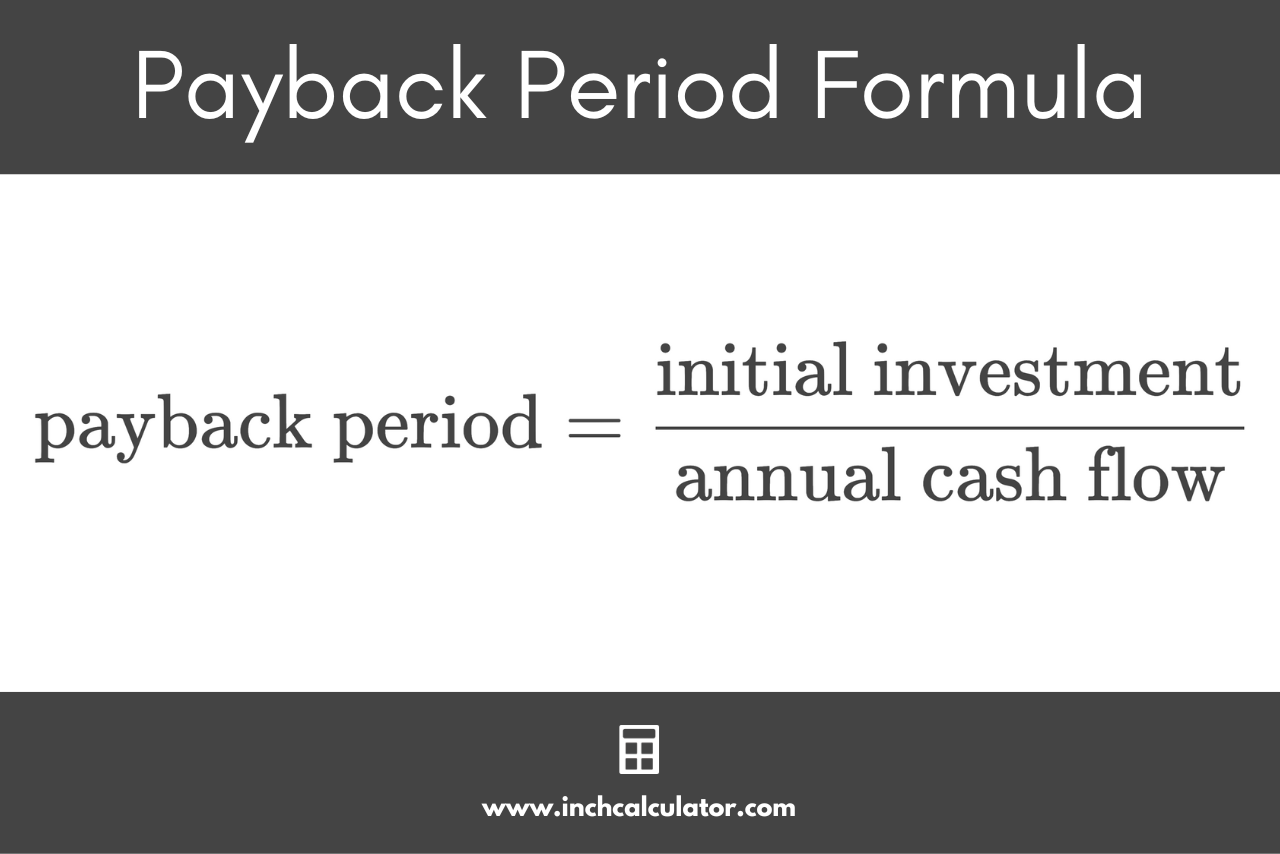

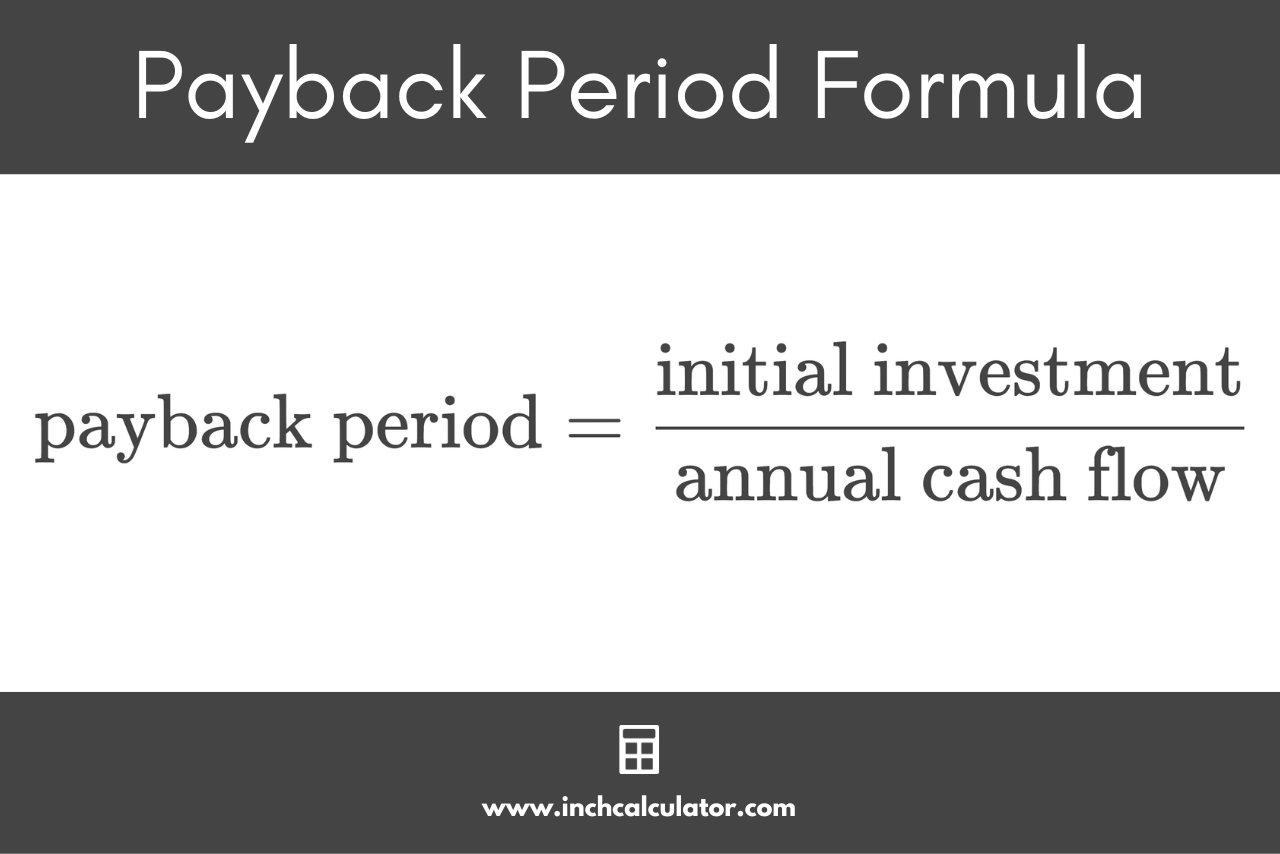

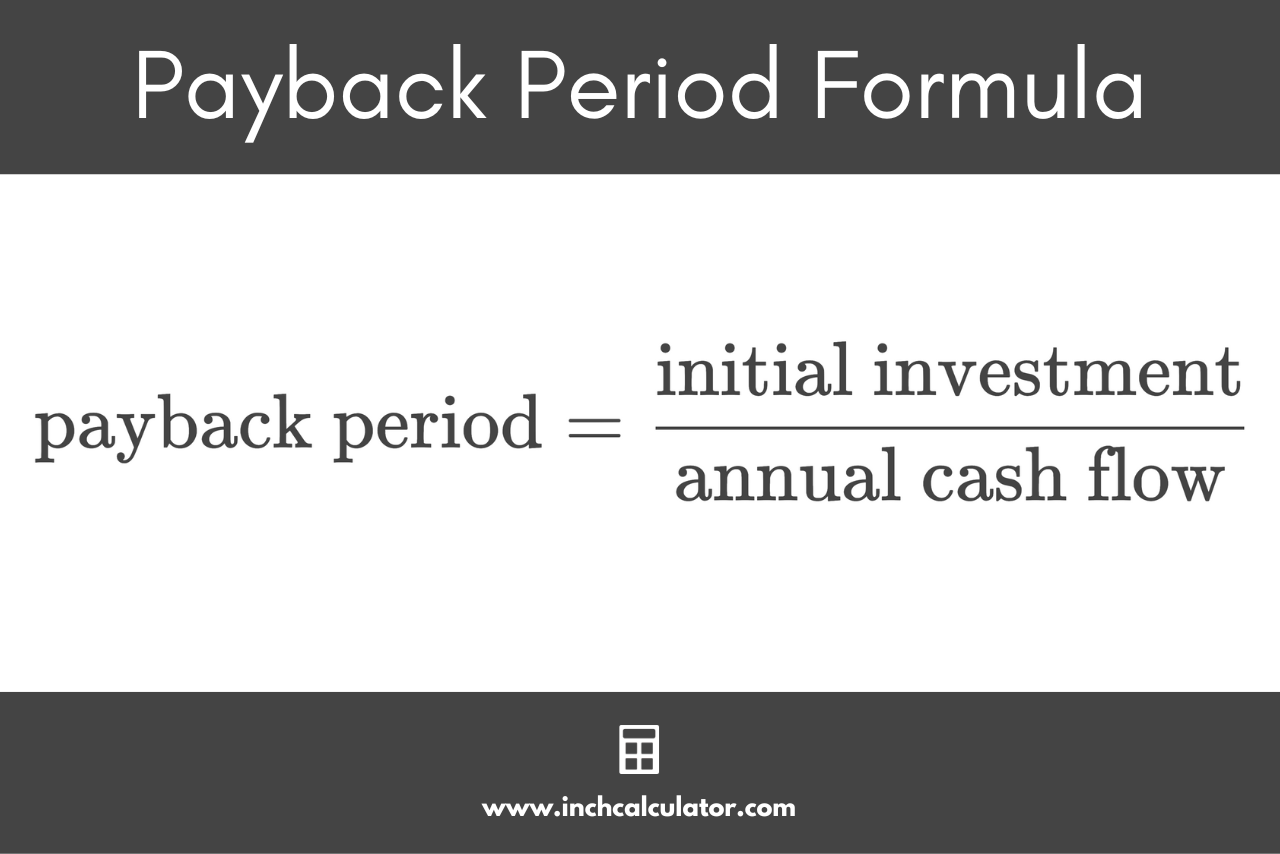

The formula for the payback period is relatively straightforward. It considers the initial investment and the expected cash flows over time. Here's a simple representation:

Payback Period = Initial Investment / Annual Cash Flows

However, when working with Excel, we can enhance our calculations and make them more dynamic. Let's explore the Excel Payback Formula and its benefits.

The Excel Payback Formula

Excel offers a built-in function called PMT (Payment) that calculates the payment for a loan or investment based on constant payments and a constant interest rate. While this function is primarily designed for loan amortization, we can adapt it to calculate the payback period.

The PMT function has the following syntax:

PMT(rate, nper, pv, [fv], [type])

- rate: The interest rate per period.

- nper: The total number of payment periods.

- pv: The present value, or the initial investment.

- fv: [Optional] The future value, or the desired ending balance (usually omitted for payback period calculations).

- type: [Optional] When to make the payments (0 for the end of the period, 1 for the beginning of the period; default is 0).

To calculate the payback period using the PMT function, we can use the following formula:

Payback Period = PMT(rate, nper, -pv) / pv

Here's a step-by-step guide to using the Excel Payback Formula:

Step 1: Define Your Variables

Before diving into the formula, ensure you have the necessary data. You will need the following:

- Initial Investment: The amount of money invested at the beginning of the project or investment.

- Annual Cash Flows: The expected cash inflows or profits generated by the project or investment each year.

- Discount Rate: The rate at which future cash flows are discounted to their present value. This represents the opportunity cost of capital or the required rate of return.

Step 2: Calculate the Discounted Cash Flows

To determine the present value of future cash flows, you can use the following formula:

Discounted Cash Flow = Cash Flow / (1 + Discount Rate)^Period

Calculate the discounted cash flows for each year of the investment period.

Step 3: Apply the PMT Function

Now, it's time to use the PMT function. Here's how you can calculate the payback period:

- Enter the PMT function in the cell where you want the payback period to be displayed.

- For the rate argument, enter the discount rate divided by the number of periods per year (e.g., if you have annual cash flows, divide the discount rate by 1; for quarterly cash flows, divide by 4, and so on).

- For the nper argument, enter the total number of periods in the investment period.

- For the pv argument, enter the initial investment with a negative sign to indicate an outflow.

- Leave the fv and type arguments blank, as they are optional and not needed for payback period calculations.

The formula should look like this:

Payback Period = PMT(Discount Rate / Periods Per Year, Number of Periods, -Initial Investment)

Step 4: Interpret the Results

Once you have calculated the payback period, you can interpret it as follows:

- A shorter payback period indicates a faster recovery of the initial investment, making the project or investment more attractive.

- A longer payback period suggests a slower recovery, which may be less desirable.

- Projects or investments with a payback period that aligns with your investment horizon or goals are generally considered more favorable.

Example: Calculating Payback Period in Excel

Let's walk through an example to calculate the payback period for a hypothetical investment project.

Suppose you are considering an investment with the following details:

- Initial Investment: $10,000

- Annual Cash Flows: $2,500 per year for 5 years

- Discount Rate: 10%

Here's how you can calculate the payback period in Excel:

- In an Excel sheet, enter the initial investment, annual cash flows, and discount rate in separate cells.

- Calculate the discounted cash flows for each year using the formula: Discounted Cash Flow = Cash Flow / (1 + Discount Rate)^Period

- Apply the PMT function to calculate the payback period: Payback Period = PMT(Discount Rate / Periods Per Year, Number of Periods, -Initial Investment)

- The calculated payback period for this investment is approximately 2.8 years.

Notes

⚠️ Note: When using the PMT function, ensure that your cash flows are consistent and regular. If your cash flows vary, you may need to adjust the formula or use alternative methods.

📌 Note: The payback period is a useful metric, but it should be used in conjunction with other financial indicators to make well-rounded investment decisions. Consider factors like internal rate of return (IRR) and net present value (NPV) for a comprehensive analysis.

🔄 Note: Remember to update your calculations if the initial investment or cash flows change over time.

Conclusion

The Excel Payback Formula is a powerful tool for evaluating investment opportunities and understanding the time it takes to recover your initial investment. By following the steps outlined in this blog post, you can confidently calculate the payback period and make informed decisions. Remember, while the payback period provides valuable insights, it is essential to consider other financial metrics for a comprehensive investment analysis.

Frequently Asked Questions

What is the significance of the payback period in investment analysis?

+

The payback period helps investors and businesses assess the time it takes to recover their initial investment. It provides insights into the liquidity and risk associated with an investment, allowing for better decision-making.

Can the payback period be used for long-term investments?

+

Yes, the payback period can be applied to both short-term and long-term investments. However, it is essential to consider the investment horizon and align the payback period with your long-term goals.

Are there any limitations to the payback period calculation?

+

The payback period calculation assumes regular and consistent cash flows. It may not accurately reflect the reality of complex investment scenarios with varying cash flows. Therefore, it should be used as a preliminary tool and complemented with other financial analyses.