Introduction to Excel Invoices

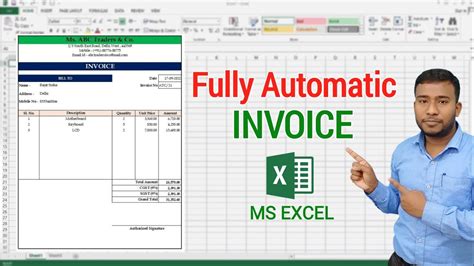

Excel is a versatile tool that can be used for various tasks, and one of its powerful features is its ability to create professional and customized invoices. Invoicing is an essential part of any business, and with Excel, you can streamline your billing process and impress your clients with a polished and efficient system. This ultimate guide will walk you through the steps to create invoices in Excel, covering everything from setting up the basic structure to adding dynamic formulas and incorporating visual elements. Whether you’re a small business owner, a freelancer, or simply want to manage your personal finances, mastering Excel invoices can revolutionize the way you handle billing.

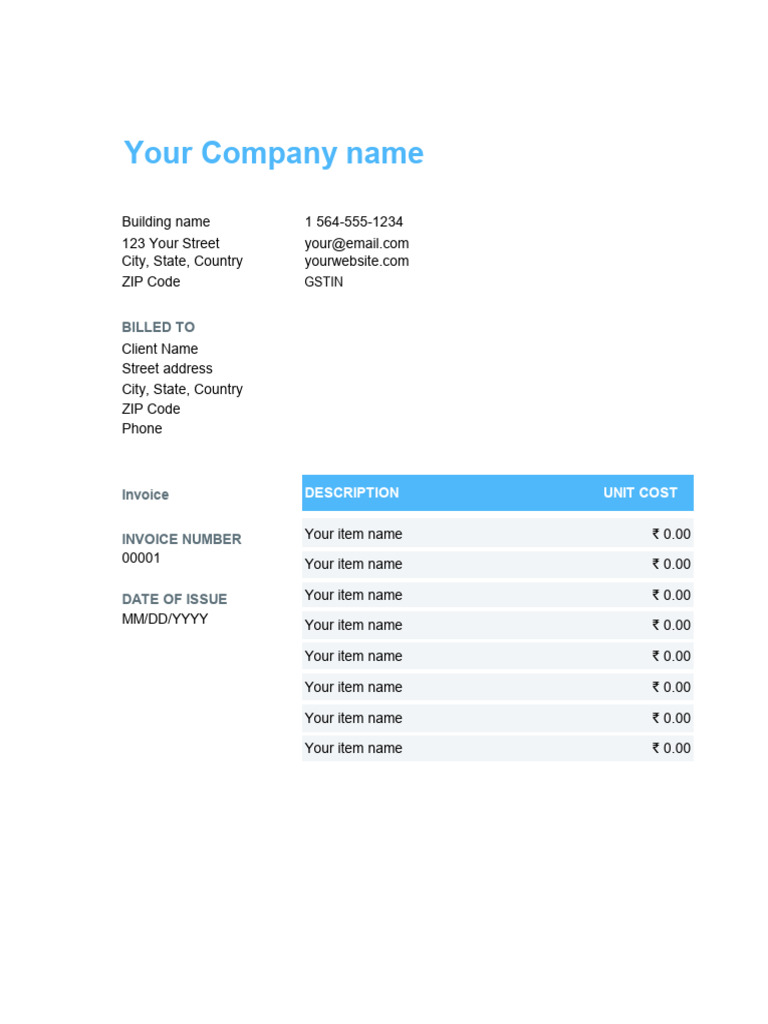

Setting Up the Excel Invoice Template

Before diving into the intricacies of Excel invoices, it’s crucial to set up a solid template that will serve as the foundation for all your future invoices. Here’s a step-by-step guide to create a basic Excel invoice template:

Step 1: Open a New Excel Workbook

- Start by opening a new Excel workbook. This will be the canvas for your invoice template.

- Rename the default worksheet to “Invoice Template” or any name that suits your preference.

Step 2: Define the Header Section

- In the header section of your worksheet, create a professional-looking header with your business name, logo, and contact information.

- You can insert your logo by going to the “Insert” tab and selecting “Pictures.” Browse and insert your logo image.

- Use bold and italic formatting to emphasize important details like your business name and contact information.

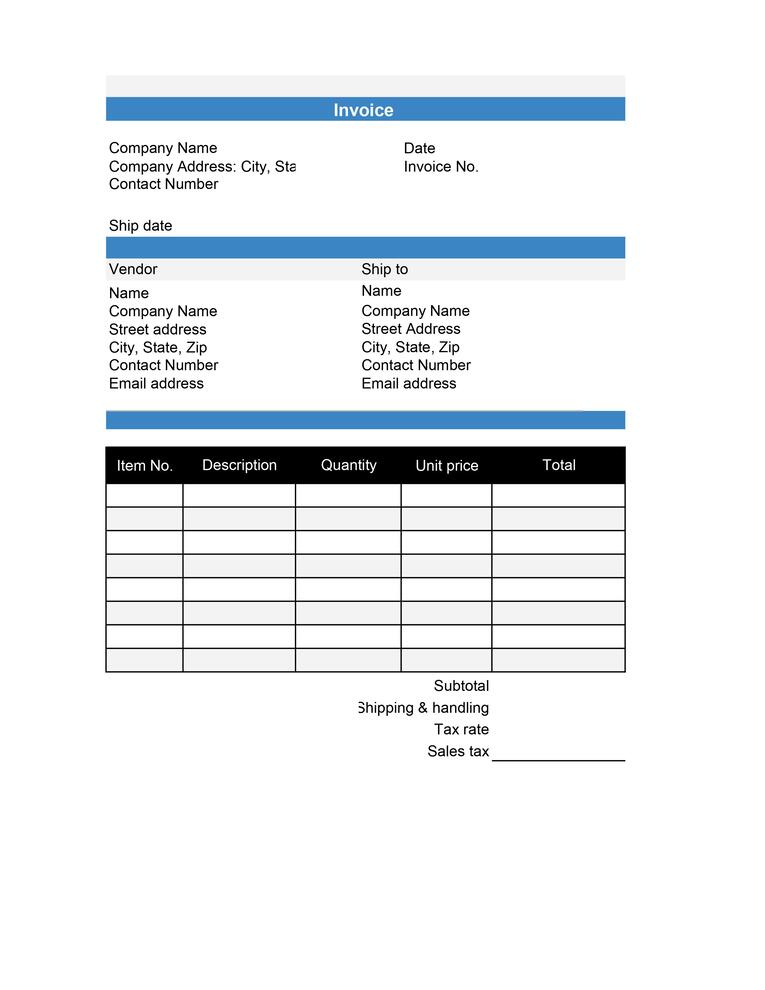

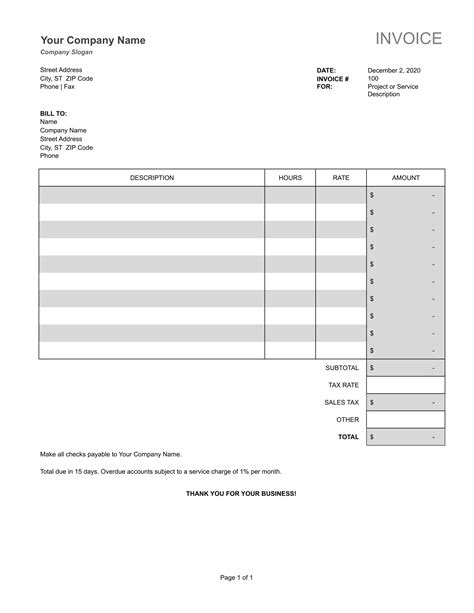

Step 3: Create the Body of the Invoice

- Below the header, create a table to accommodate the invoice details. This table will contain columns for item descriptions, quantities, unit prices, and totals.

- Merge cells to create a centered title for the table, such as “Invoice Details.”

- Define the columns:

- Item Description: This column will describe the products or services provided.

- Quantity: The number of items or hours worked.

- Unit Price: The price per item or service.

- Total: The calculated total for each line item.

Step 4: Add Formulas for Calculations

- In the “Total” column, insert a formula to calculate the total for each line item. For example, =D2*E2, where D2 is the quantity, and E2 is the unit price.

- Create a separate cell for the “Subtotal” calculation, which sums up all the line item totals. Use the SUM function for this, e.g., =SUM(F2:F10) (assuming your table has 10 rows).

- Optionally, you can add tax calculations by creating a “Tax Amount” column and applying a formula to calculate the tax based on the subtotal.

Step 5: Save and Customize Your Template

- Once you’ve set up the basic structure, save your template as a separate Excel file. This way, you can easily duplicate and modify it for future invoices.

- Customize the template further by adding your business colors, fonts, and any other design elements to make it unique and visually appealing.

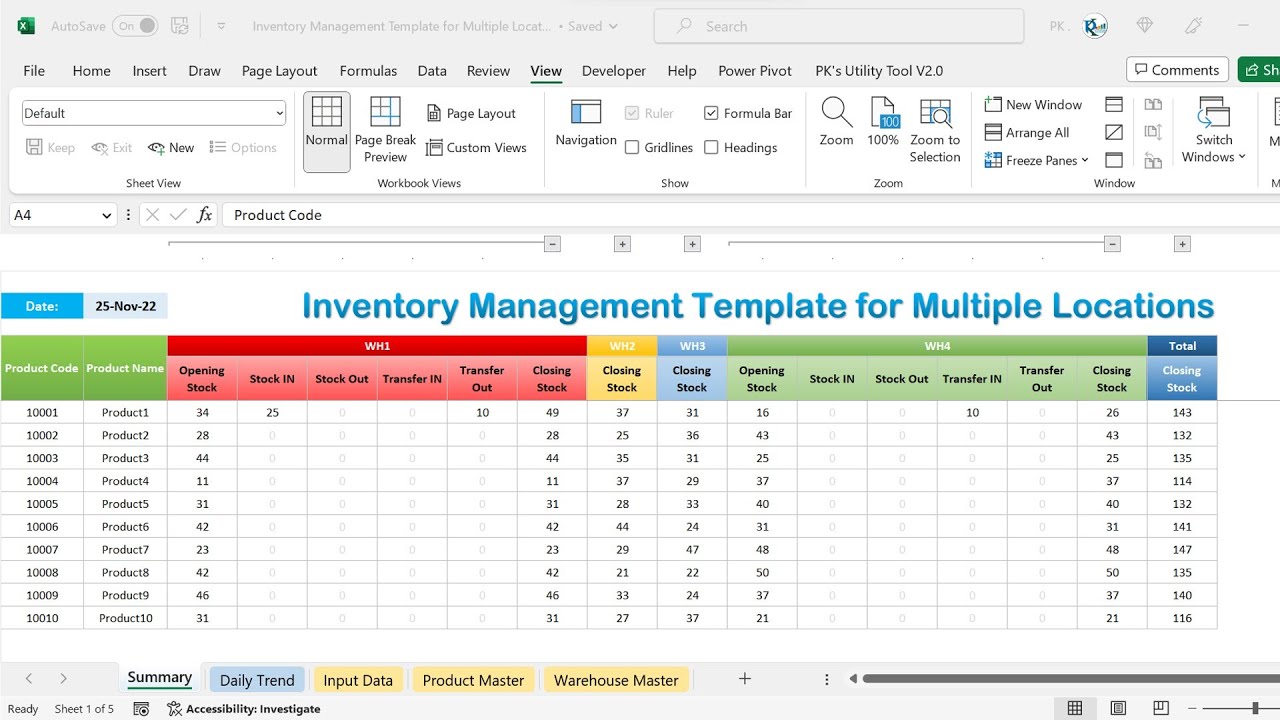

Adding Dynamic Formulas and Functions

Excel’s true power lies in its ability to perform complex calculations and automate tasks. When creating invoices, dynamic formulas and functions can save you time and reduce the risk of errors. Here are some essential formulas and functions to incorporate into your Excel invoices:

Step 1: Calculate Subtotals and Totals

- As mentioned earlier, use the SUM function to calculate the subtotal of all line items. This ensures that the total amount on your invoice is accurate.

- If you have multiple sections or categories on your invoice, you can use the SUMIF function to calculate subtotals for each section.

Step 2: Apply Tax Calculations

- To calculate tax amounts, you can use the IF function along with the SUM function. For example, =IF(F2=“Taxable”, SUM(F2:F10)*0.1, 0) assumes a 10% tax rate.

- If your tax rates vary based on different products or services, you can create a separate tax rate table and use the VLOOKUP function to retrieve the correct tax rate for each item.

Step 3: Handle Discounts and Adjustments

- If you offer discounts or need to make adjustments to the invoice, you can use the IF function to calculate the discount amount. For instance, =IF(G2>0, F2*G2, 0) assumes a discount percentage in cell G2.

- For more complex discount structures, you can create a separate table with discount rates and use the VLOOKUP function to apply the correct discount to each item.

Step 4: Automate Due Dates and Payment Terms

- To keep track of payment due dates, you can use the TODAY function to automatically calculate the due date based on your payment terms. For example, =TODAY() + 30 will add 30 days to the current date, indicating a 30-day payment term.

- You can also use the EOMONTH function to calculate the due date based on the end of the month.

Incorporating Visual Elements

A well-designed invoice not only looks professional but also enhances the overall user experience. Excel allows you to incorporate various visual elements to make your invoices more appealing and easier to read. Here are some tips for adding visual appeal to your Excel invoices:

Step 1: Use Conditional Formatting

- Conditional formatting can highlight important information on your invoice, such as overdue payments or discounts applied.

- For example, you can format cells to turn red if the payment is overdue or green if the invoice has been paid.

Step 2: Insert Charts and Graphs

- Visual representations of data can provide a quick overview of your invoice. For instance, you can create a pie chart to show the distribution of expenses or a bar chart to compare different line items.

- Charts can also be used to illustrate payment trends or project future revenue based on past invoices.

Step 3: Utilize Data Validation

- Data validation ensures that users enter valid information into your invoice template. For example, you can restrict the quantity column to accept only positive numbers.

- You can also use data validation to create drop-down lists for item descriptions, making it easier for users to select from a predefined list of products or services.

Finalizing and Sending Your Excel Invoice

Once you’ve created a polished and functional Excel invoice template, it’s time to finalize and send it to your clients. Here are some tips to ensure a smooth invoicing process:

Step 1: Review and Proofread

- Before sending your invoice, thoroughly review it for any errors or typos. Pay attention to the calculations, formatting, and overall presentation.

- Check the accuracy of the calculations, especially if you’ve used complex formulas or functions.

Step 2: Save as PDF or Print

- To ensure your invoice retains its formatting and visual elements, save it as a PDF file. This format is widely accepted and preserves the integrity of your design.

- Alternatively, you can print your invoice on high-quality paper to give it a professional touch.

Step 3: Send via Email or Online Platforms

- The most common method of sending invoices is via email. Attach your PDF invoice to an email and include a personalized message to your client.

- If you use online invoicing platforms or accounting software, you can export your Excel invoice as a CSV or XLSX file and upload it to the platform.

Step 4: Follow Up and Track Payments

- After sending your invoice, follow up with your clients to ensure they receive it and are aware of the payment due date.

- Keep track of payment status and send gentle reminders if necessary. Excel can help you with this by creating a separate worksheet to record payment dates and amounts.

Conclusion

Creating Excel invoices is a powerful way to streamline your billing process and maintain a professional image. By following this ultimate guide, you’ve learned how to set up a basic invoice template, add dynamic formulas and functions, and incorporate visual elements to enhance the overall user experience. With Excel’s versatility, you can customize your invoices to fit your unique business needs and impress your clients with a polished and efficient billing system. Remember to review and proofread your invoices, save them in a suitable format, and follow up on payments to ensure a smooth and successful invoicing process.