Calculating the Weighted Average Cost of Capital (WACC) is a crucial step in financial analysis and valuation. It provides an essential metric for businesses and investors to assess the overall cost of their capital structure. Excel, with its powerful capabilities, can simplify this complex calculation. In this comprehensive guide, we will walk you through the step-by-step process of calculating WACC in Excel, empowering you to make informed financial decisions.

Understanding the Components of WACC

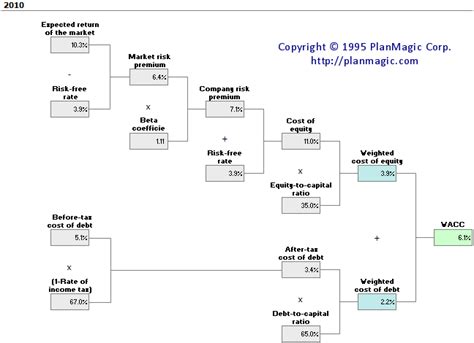

Before diving into the calculation, let's break down the components of WACC:

- Cost of Equity (Re): This represents the return that shareholders require as compensation for the risk of investing in the company's equity. It is often estimated using the Capital Asset Pricing Model (CAPM) or other valuation techniques.

- Cost of Debt (Rd): Refers to the interest rate a company pays on its debt. It is usually the after-tax cost of debt, as interest expenses are tax-deductible.

- Market Value of Equity (MVE): Represents the total value of the company's outstanding shares.

- Market Value of Debt (MVD): Reflects the total value of the company's outstanding debt.

- Corporate Tax Rate (T): The effective tax rate that the company pays on its earnings.

The WACC formula can be expressed as:

WACC = Re × MVE × (1 - T) + Rd × MVD × (1 - T)

Now, let's explore how to calculate each component and assemble them to find the WACC in Excel.

Step-by-Step Guide to Calculating WACC in Excel

-

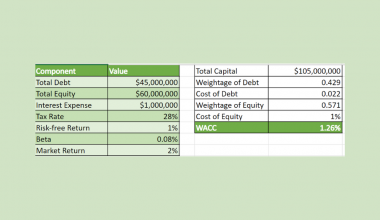

Gathering the Necessary Data

To calculate WACC, you'll need the following information:

- Cost of Equity (Re)

- Cost of Debt (Rd)

- Market Value of Equity (MVE)

- Market Value of Debt (MVD)

- Corporate Tax Rate (T)

-

Setting Up the Excel Sheet

Create a new Excel sheet and organize your data as follows:

Parameter Value Cost of Equity (Re) [Enter Value] Cost of Debt (Rd) [Enter Value] Market Value of Equity (MVE) [Enter Value] Market Value of Debt (MVD) [Enter Value] Corporate Tax Rate (T) [Enter Value]

-

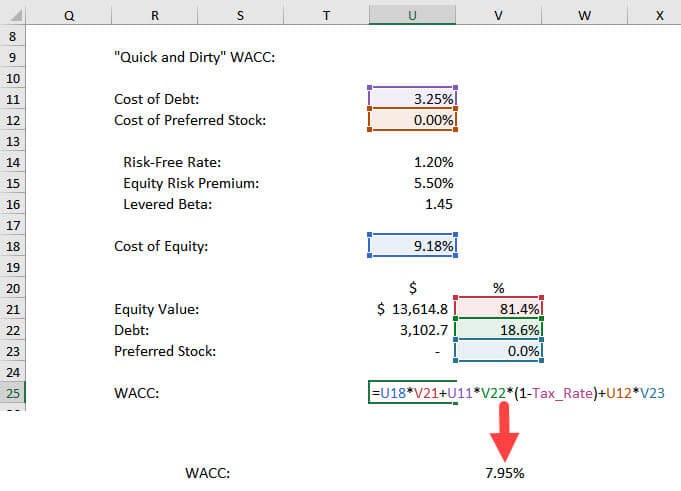

Calculating the Weighted Average Cost of Capital (WACC)

Use the following formula in a cell to calculate WACC:

WACC = Re × MVE × (1 - T) + Rd × MVD × (1 - T)

Replace

Re,Rd,MVE,MVD, andTwith the appropriate cell references in your Excel sheet.

Notes

💡 Note: Ensure that you input accurate and up-to-date values for each parameter to obtain precise WACC calculations.

⚠️ Caution: Remember that WACC is an estimate and may vary based on market conditions and assumptions. Regularly update your calculations to reflect changing market dynamics.

Now that you have calculated the WACC, let's explore some practical applications and insights derived from this financial metric.

Practical Applications of WACC

- Valuation and Investment Decisions: WACC is a critical tool for valuing a company and making investment decisions. It helps assess the expected return on investment and compare it with the company's cost of capital.

- Capital Structure Analysis: By calculating WACC, businesses can analyze the impact of different capital structures on their overall cost of capital. This enables them to optimize their financing mix and make informed decisions regarding debt and equity.

- Discounting Cash Flows: WACC is commonly used as the discount rate when evaluating the present value of future cash flows. It ensures that the cash flows are discounted at a rate that reflects the company's cost of capital, providing a more accurate valuation.

Remember, WACC is a dynamic metric that should be regularly updated to account for changing market conditions, interest rates, and corporate tax rates. By staying vigilant and conducting thorough financial analysis, you can make well-informed decisions and optimize your investment strategies.

Conclusion

Calculating the Weighted Average Cost of Capital (WACC) in Excel is a powerful tool for financial analysts and investors. By following the step-by-step guide provided in this blog, you can confidently calculate WACC and gain valuable insights into a company's financial health and valuation. Remember to stay updated with market trends and regularly review your calculations to make informed decisions. With WACC as your compass, you can navigate the complex world of finance with precision and accuracy.

Frequently Asked Questions (FAQ)

What is the significance of WACC in financial analysis?

+

WACC is a crucial metric in financial analysis as it represents the overall cost of a company's capital structure. It helps investors and analysts assess the expected return on investment and make informed decisions regarding capital allocation and valuation.

<div class="faq-item">

<div class="faq-question">

<h3>How often should I update my WACC calculations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It is recommended to update your WACC calculations regularly, especially when there are significant changes in market conditions, interest rates, or corporate tax rates. Staying up-to-date ensures that your financial analysis reflects the current state of the market.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can WACC be used for personal finance calculations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While WACC is primarily used for corporate finance and investment analysis, it can also be adapted for personal finance calculations. By considering your personal debt and equity holdings, you can estimate your personal WACC to assess the cost of your capital structure.</p>

</div>

</div>